Exploring Further : The Formula for The True Mortgage Calculation

When it comes to buying a home, understanding your mortgage is essential. Numerous new buyers often focus simply on the advertised monthly payment, but the real cost of a mortgage includes far greater than that. To navigate this complicated financial landscape, it's crucial to dive into the details into the different components that make up your mortgage and determine a figure that genuinely reflects your financial commitment.

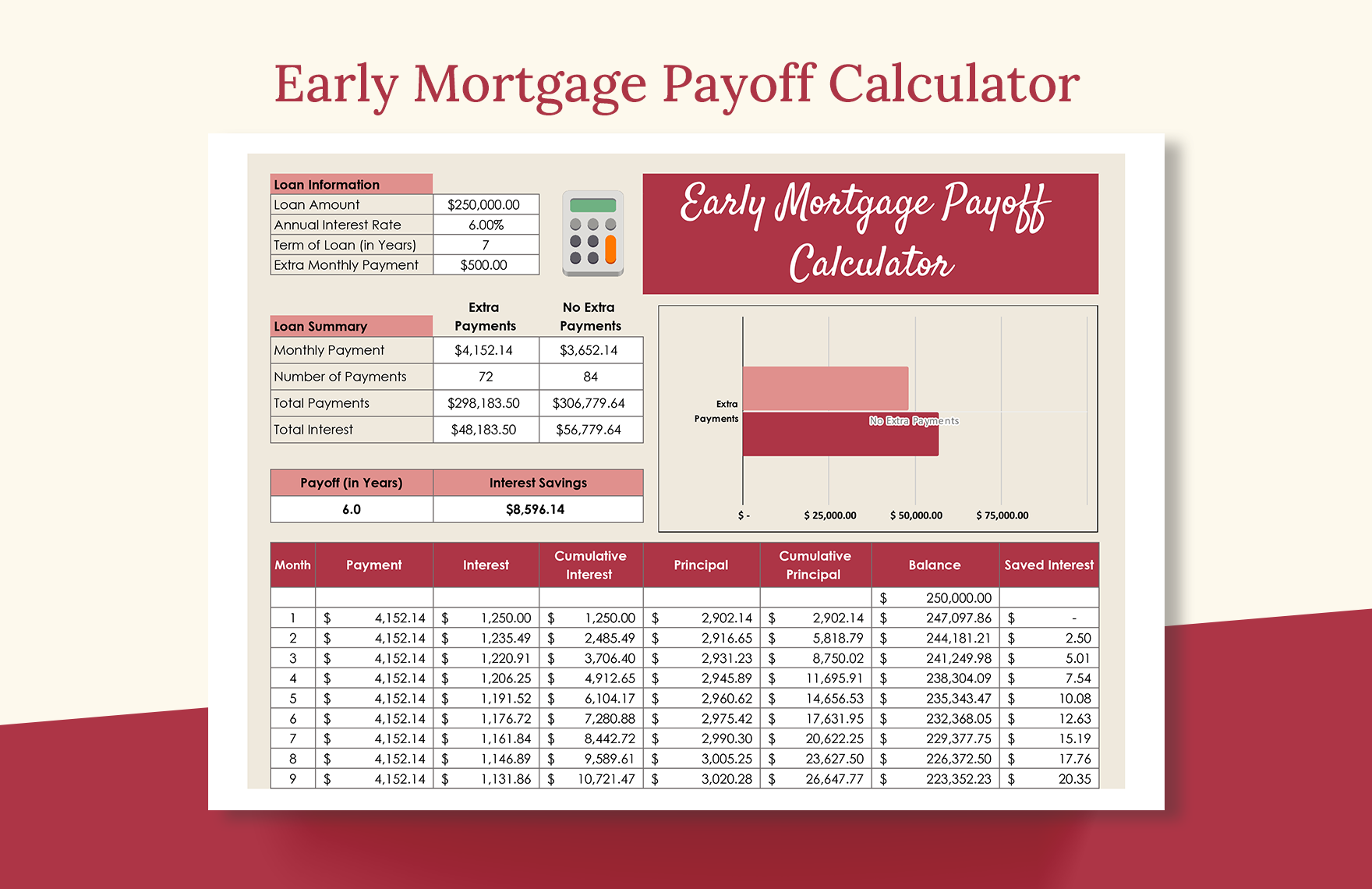

Employing a mortgage calculator can be a great place to start, but it’s crucial to know what inputs will provide you the most precise picture. Loan interest rates, loan terms, property taxes, and insurance can all influence your monthly payment. By assessing these factors holistically, you can identify not just what you will pay on a monthly basis, but also how even a minor change such as a slightly higher interest rate can lead to substantially higher costs over the life of your loan. In this article, we will lead you through the phases to calculate your true mortgage calculation, helping you make informed decisions for your financial future.

Understanding Home Loan Fundamentals

A home loan is a type of financing exclusively used to buy real estate, where the property itself serves as collateral. This type of loan allows homebuyers to buy homes without pay the entire price upfront. Understanding the fundamental components of a mortgage, including principal, interest, taxes, and insurance, is important for any potential buyer. The principal is the amount borrowed, while interest is the cost of borrowing that funds, expressed as a percentage.

When you secure a mortgage, you usually pay back it over a set period, commonly 15 to 30 years. hipotecalc.com are composed of both principal and interest, and they can also comprise property taxes and homeowners insurance. This combination can render it confusing for new buyers to understand their total monthly commitment. Utilizing a mortgage calculator can simplify this process, helping you see how different loan amounts, interest rates, and loan terms affect your payments.

It is also vital to think about additional costs related with homeownership that may not be included your monthly mortgage payment. These can include maintenance, repairs, and homeowners association fees if relevant. Being aware of these expenses will help give a clearer picture of what your true mortgage costs will be over time. By understanding the fundamentals of mortgages, you will be more equipped to handle the financial landscape of purchasing a home.

Figuring Out The Monthly Payments

To determine the amount of your monthly mortgage payments, you must start by gathering the principal amount, the cost of borrowing, and the loan term. The principal represents the entirety borrowed, and the borrowing cost is the annual cost of borrowing shown as a percentage. The loan term refers to how long you have to repay the borrowed amount, typically 15 years, 20 years, or 30 years. Knowing these factors is crucial because they make up the core of calculating your mortgage.

Once you have these figures, you should use a mortgage calculator to determine your monthly payment. Input the amount you borrowed, the borrowing percentage, and duration of the loan within the mortgage calculator. Numerous calculators may permit you to include property taxes and insurance, which provides you a better estimate of your monthly payment. This step is crucial, because it shows you how different scenarios, such as varying interest rates or loan terms, will impact your monthly budget.

Ultimately, after calculating your monthly mortgage payment, make sure you feel comfortable with what you will pay. It is recommended to factor in extra expenses that come with owning a home, including maintenance, utilities, and homeowner association fees. Being aware of the entire financial obligation enables you to make an informed decision regarding your mortgage and to make certain it fits into your financial plan.

Factors Affecting Mortgage Rates

Several factors determine home loan rates, and understanding them can help borrowers make wise decisions when seeking a loan. An significant factor is the financial environment, especially inflation and interest rates determined by central banks. When inflation increases, central banks may raise the interest rate to manage it, resulting in higher mortgage rates. On the other hand, in a low-inflation environment, the rates could drop, making taking out a loan more affordable.

Another critical aspect is your creditworthiness score. Banks take into account credit scores to assess the level of risk of providing money. Higher credit scores show lower risk, which typically leads to more favorable mortgage interest rates. Conversely, a lower credit score may cause higher rates or even trouble getting a loan. It is crucial to preserve a good credit score to obtain the most favorable possible loan terms.

Finally, the type of mortgage you choose can affect your interest rate. Fixed mortgages tend to have increased interest rates than variable-rate mortgages initially, but they give stability over time. On the flip side, adjustable-rate mortgages can start with lower interest rates but can change based on the market after an initially fixed fixed-rate period. Your decision will be based on your financial situation and how long you intend to live in your home.