Unlocking Success: The Ultimate Guide to Financial Model Templates

In today's fast-paced business environment, understanding your financial landscape is more crucial than ever. Whether you are a startup seeking investment or an established company planning for future growth, financial model templates can be your guiding light. These templates not only streamline the modeling process but also provide a solid foundation for making informed financial decisions. By adopting a well-structured financial model, you can better analyze your company's potential, forecast revenues, and manage expenses effectively.

Financial model templates come in various forms, each tailored to different aspects of business finance. From simple cash flow models to complex integrated financial statements, these tools help simplify the complexities of financial planning. By using these templates, you can save time and effort, enabling you to focus on what truly matters—growing your business and achieving your financial goals. In this ultimate guide, we will explore the world of financial model templates and how they can unlock the doors to your success.

Types of Financial Model Templates

Financial model templates can vary widely depending on the specific needs of a business or project. One common type is the three-statement model, which integrates the income statement, balance sheet, and cash flow statement into a cohesive framework. This model is essential for businesses to project their financial performance and understand the interconnections between different financial statements. It provides a comprehensive overview of how operational activities affect the overall financial health of an organization.

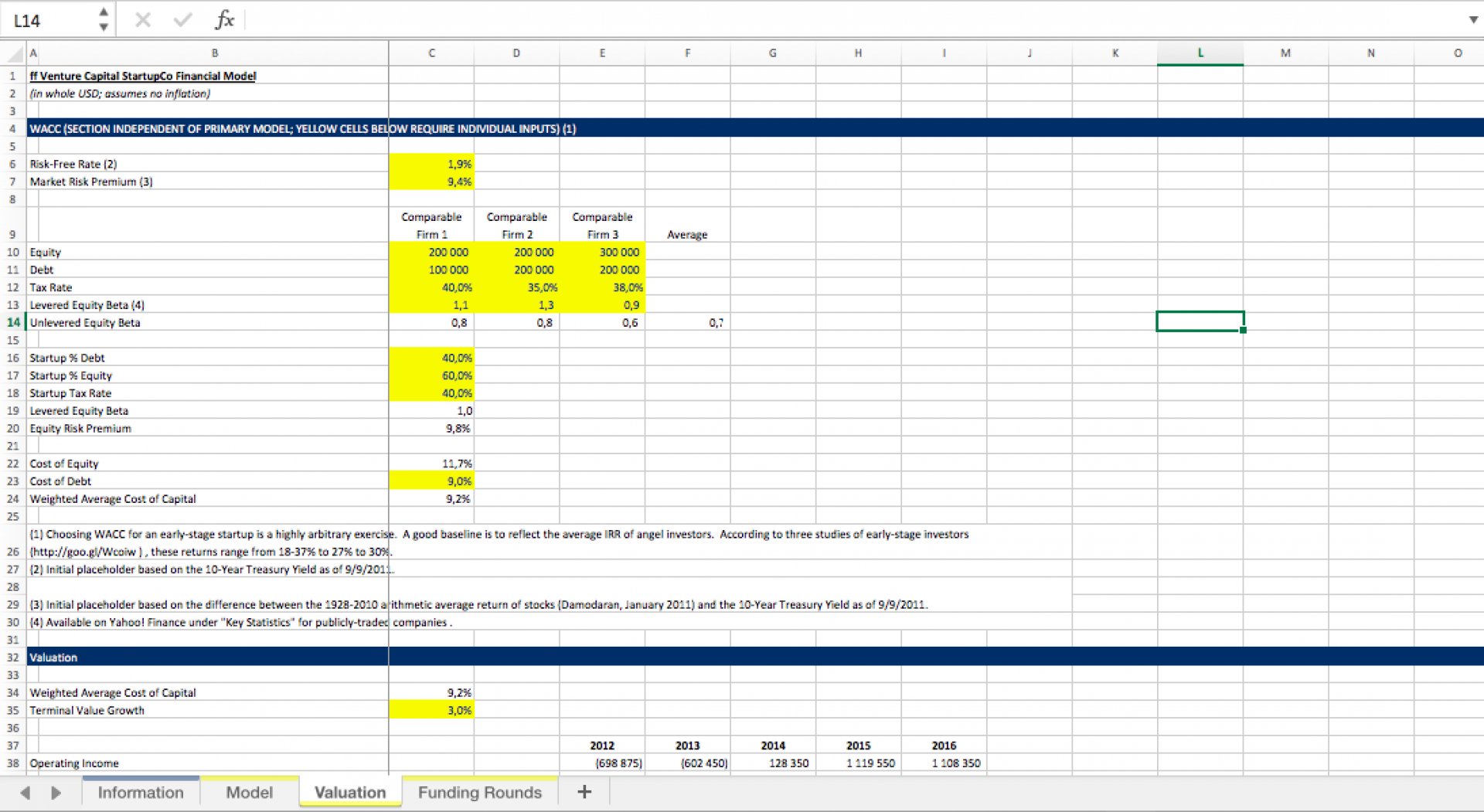

Another popular type of financial model template is the discounted cash flow (DCF) model. This model is particularly useful for evaluating the value of an investment by forecasting cash flows and discounting them back to their present value. DCF models are often used in valuation scenarios, such as mergers and acquisitions or capital budgeting decisions. They help investors make informed decisions by assessing the potential profitability of an investment based on future cash generation.

A third type of financial model template is the budgeting model, designed to assist businesses in planning and managing their finances over a defined period. Budgeting models provide a framework for setting financial goals, allocating resources, and tracking performance against those goals. These templates are crucial for operational planning, enabling organizations to anticipate costs, revenue, and overall financial performance while adapting to changing economic conditions.

Key Components of a Financial Model

A financial model typically consists of several key components that work together to provide a comprehensive view of a business’s financial situation. First and foremost, input assumptions form the foundation of any effective financial model. These inputs include revenue drivers, cost assumptions, and growth rates, which are essential for forecasting future performance. Clearly defined assumptions help ensure that the model is both reliable and adaptable to changing circumstances.

Another critical component is the income statement, which outlines the company’s revenues, expenses, and profitability over a specified period. This statement highlights the operational efficiency and enables stakeholders to assess how well the company is converting sales into profit. Alongside the income statement, the cash flow statement is vital for understanding the actual inflow and outflow of cash, ensuring that a business can meet its obligations and invest in future growth.

Lastly, the balance sheet is an integral part of a financial model as it provides a snapshot of the company’s assets, liabilities, and equity at a given point in time. This component helps stakeholders evaluate the financial health and leverage of the business, offering insights into its ability to support operations and fund growth strategies. Together, these components form a cohesive financial model that serves as a tool for decision-making and strategic planning.

Best Practices for Using Financial Models

Effective use of financial model templates begins with clarity of purpose. Before diving into the model, clearly define the objective of your analysis. This could range from evaluating a new investment opportunity to conducting a valuation of a business. By having a specific goal in mind, you can tailor your model to suit your needs, ensuring it becomes a useful tool rather than a complex spreadsheet that is difficult to navigate.

Another key practice is to maintain simplicity and transparency in your models. A well-structured financial model should be easy to read and understand, allowing others to follow your logic and calculations. Utilize clear labeling, consistent formatting, and a step-by-step approach to guide users through your assumptions, inputs, and outputs. Avoid overly complicated formulas and unnecessary complexity, as this can lead to errors and confusion, making it difficult to communicate findings to stakeholders.

Lastly, regularly update and review your financial models to reflect new data and changing circumstances. Financial conditions and assumptions can evolve, and it is vital to revisit your model frequently to ensure its relevance and accuracy. Schedule routine audits of your financial model to identify any discrepancies and to verify that it is aligned with your current objectives. This practice not only strengthens the reliability of your analysis but also enhances your decision-making processes.