Decoding Medicare: The Ultimate Guide to Healthcare Coverage

Welcome to the ultimate guide on Medicare, your go-to resource for understanding this vital healthcare coverage. Navigating the complex world of health insurance can often be overwhelming, but with Medicare, you gain access to a comprehensive program tailored specifically for individuals aged 65 and older, as well as certain qualifying younger individuals with disabilities. In this article, we will explore the different parts of Medicare, enrollment requirements, coverage options, and important considerations when selecting a plan. Whether you're new to Medicare or looking to make informed decisions about your existing coverage, let's unravel the mysteries together and empower you with the knowledge you need to take charge of your healthcare journey.

Understanding the Different Parts of Medicare

Medicare is a comprehensive health insurance program in the United States that provides coverage for a range of medical services. It is essential to understand the different parts of Medicare to make informed decisions about your healthcare coverage.

Original Medicare: Parts A and B

Original Medicare is the foundation of the Medicare program and consists of two essential parts: Part A and Part B.

-

Medicare Part A: Often referred to as hospital insurance, Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services.

-

Medicare Part B: Part B is medical insurance that covers doctor visits, outpatient care, preventive services, and medically necessary supplies.

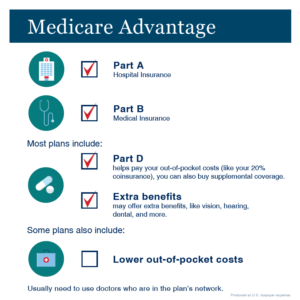

Medicare Advantage: Part C

Medicare Advantage, also known as Part C, is an alternative to Original Medicare offered by private insurance companies approved by Medicare. These plans combine the benefits of Part A, Part B, and often Part D (prescription drug coverage) into a single plan. Medicare Advantage plans may also provide additional benefits, such as vision, dental, or hearing coverage.

Prescription Drugs: Part D

Medicare Part D is prescription drug coverage that helps pay for the cost of prescription medications. Part D plans are available through private insurance companies approved by Medicare. It is essential to enroll in a Part D plan if you require prescription medications, as Original Medicare does not typically cover these costs.

Understanding the different parts of Medicare can help you make informed decisions about your healthcare coverage. Whether you choose Original Medicare or Medicare Advantage, ensuring that you have appropriate coverage for your healthcare needs is crucial. Additionally, considering factors such as Medicare enrollment, eligibility, costs, and available benefits can help you navigate the complexities of the Medicare system effectively.

Navigating Medicare Enrollment and Eligibility

When it comes to Medicare, understanding the enrollment process and eligibility requirements is crucial. This section aims to simplify the complexities surrounding Medicare enrollment and help you determine your eligibility for this important healthcare coverage.

To be eligible for Medicare, you must be a U.S. citizen or a legal resident who has lived in the country for at least five consecutive years. Additionally, you need to meet certain age criteria or have a qualifying disability. Medicare Supplement Plans become eligible for Medicare when they turn 65, but if you have a disability or certain medical conditions, you may qualify at a younger age.

Enrolling in Medicare is essential to ensure that you can access the healthcare benefits it provides. To enroll in Original Medicare (Part A and Part B), you can do so during the Initial Enrollment Period (IEP). This period starts three months before your 65th birthday month and continues for three months after. It's important to note that if you miss this initial enrollment window, you may face late enrollment penalties.

There are also other Medicare options available, such as Medicare Advantage (Part C) and Medicare Part D (prescription drug coverage). These plans have their own enrollment periods and eligibility criteria, so it's important to explore your options and choose the plan that best suits your healthcare needs. Remember, being informed about the enrollment process and knowing your eligibility status will help you make the right decisions when it comes to your Medicare coverage.

Managing Medicare Costs and Coverage

As you navigate through the complexities of Medicare, it is important to understand how to manage both the costs and coverage of this healthcare program.

Medicare Costs

When it comes to Medicare, there are various costs to consider. One important factor is your Medicare Part B premium, which is a monthly fee that helps cover your medical services and supplies. The amount you pay for this premium is based on your income, with higher-income individuals paying a higher premium.

Another cost to keep in mind is your Medicare Part A premium. For most people, this premium is $0, as long as they have paid Medicare taxes while working for a certain time. However, if you haven't met the necessary requirements, there may be a premium associated with Part A.

Additionally, Medicare may require you to pay deductibles, coinsurance, and copayments for certain services. These out-of-pocket costs can vary depending on the specific Medicare plan you have and the services you receive. It's important to review your plan's details to understand how much you may need to pay for different healthcare services.

Medicare Coverage

Understanding your Medicare coverage is crucial to ensuring you receive the necessary healthcare services. Original Medicare, which includes Parts A and B, provides coverage for various services such as hospital stays, doctor visits, preventive care, and durable medical equipment.

Medicare Part C, also known as Medicare Advantage, offers an alternative way to receive your Medicare benefits. These plans are offered by private insurance companies and often provide additional benefits beyond what Original Medicare covers. It's important to review the specific details of these plans to understand what services are included and how they may differ from Original Medicare.

Prescription drug coverage is available through Medicare Part D. These plans help cover the costs of prescription medications, and they are offered by private insurance companies. It's important to ensure that the medications you need are covered under your chosen Part D plan.

By understanding the costs and coverage associated with Medicare, you can make informed decisions about your healthcare. It's important to review your options, compare plans, and consider your individual healthcare needs to find the best Medicare plan that suits your budget and provides the necessary coverage for your medical needs.