Unlocking the Currency Marketplace: The supreme Beginner's Guidebook to Forex Trading

Forex trading, or foreign currency trading, has gained immense popularity among persons seeking to shift their investment casinos and achieve economical independence. As some sort of beginner, entering the world of forex can be each exciting and overwhelming. With a market that will operates 24 several hours a day, enormous liquidity, and the potential for significant profits, it's essential to equip yourself together with the right expertise and strategies ahead of diving in.

This extensive guide will walk you through everything you need to know about forex trading for novices. From understanding essential language to having a back again trading strategy, all of us will explore important concepts such like market analysis, chance management, along with the effect of economic media. Whether investigate this site are usually thinking about day trading, swing trading, or even simply want to learn just how to navigate the forex market, our own insights will help you unlock typically the secrets to productive trading and stay away from common pitfalls alongside the way.

Top Forex Trading Strategies

One regarding the most powerful forex trading tactics is trend right after. This strategy entails identifying the way in the market plus placing trades within the same direction. Traders may use different tools for example relocating averages and pattern lines to realize trends and make well informed decisions. By staying with the trend, dealers enhance their chances regarding success, as markets tend to move in long-lasting trends as opposed to making random actions.

One other popular strategy will be range trading. This approach is based on discovering levels of support and even resistance, where costs are likely to bounce off of these levels. Investors by using this strategy buy at support in addition to sell at weight, aiming to capture profits within typically the established range. Range trading can always be particularly effective found in stable markets where fluctuations are small, allowing traders in order to capitalize on predictable price movements.

Scalping is definitely a fast-paced trading strategy that targets making quick revenue from small value changes. Scalpers execute numerous trades throughout the day, holding positions for a very short period of time. This process requires some sort of solid understanding of market mechanics along with a trusted trading plan, because well as quick decision-making skills. Scalping could be highly satisfying for those who can successfully manage their moment and risk although capitalizing on small market fluctuations.

Understanding Forex Market Analysis

Forex marketplace analysis is crucial for traders that aim to make informed decisions in the particular fast-paced currency market. There are two major methods of examination: fundamental analysis and technical analysis. Fundamental research focuses on economic indications, geopolitical events, in addition to central bank procedures to predict foreign currency movements. Traders appearance at factors like interest rates, joblessness rates, and inflation data to evaluate the general health involving a country's economy. By understanding these types of elements, traders can easily better anticipate precisely how global economic adjustments will impact forex values.

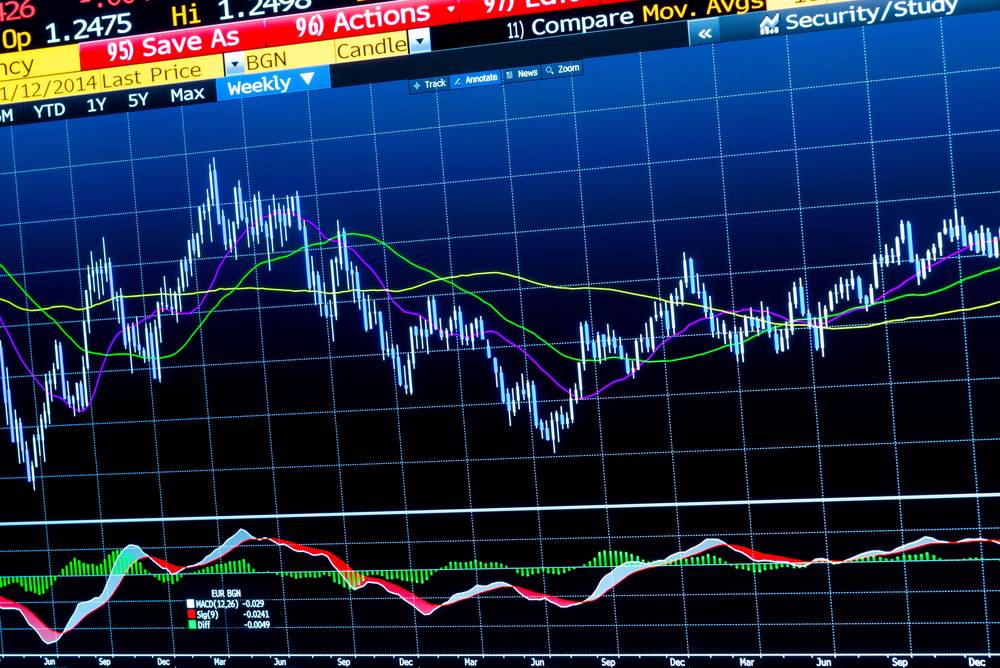

On the some other hand, technical analysis relies upon historical cost data and chart patterns to help make predictions about future price movements. Traders use various tools and indicators, this kind of as moving takes up and trend traces, to analyze industry trends and determine trading opportunities. This particular method assumes of which all relevant info is already reflected in the price, permitting traders to make decisions based in price action rather than underlying financial conditions. Understanding of graph and or chart patterns and signals can provide an important advantage when getting into or exiting trades.

Merging both fundamental and even technical analysis can give traders a comprehensive view from the market. By understanding the broader economic context through fundamental examination and using technical tools to moment their trades, forex traders can develop a more strong trading strategy. This integrated approach enables better anticipation regarding market movements and may lead to even more consistent profits found in the competitive forex trading landscape.

Risikomanagement in addition to Trading Mindset

Effective risk management is imperative for success in Forex trading. It consists of identifying potential hazards and implementing strategies to mitigate these people. A common strategy would be to determine your risk tolerance plus set limits how much capital you will be willing to shed about the same trade. This particular usually means risking no more than 1 to 2 percent of your trading capital on each trade. Additionally, using stop-loss orders can aid protect your investments and minimize failures, letting you trade together with a clearer head and give attention to strategic decisions instead of psychological stress.

Understanding trading mindset is essential. Feelings such as fear and greed can easily heavily influence trading decisions, often ultimately causing poor choices. Successful traders develop the discipline to stick for their trading plans and strategies, irrespective of market situations. Maintaining a relaxed mindset helps traders help to make rational decisions and avoid impulsive steps, such as overtrading or holding on to losing positions within hopes of a reversal. Incorporating mindfulness techniques and regular self-assessment can boost emotional control in the high-pressure surroundings of Forex trading.

Handling risk management and even trading psychology makes a solid foundation intended for a successful career in Forex trading. By effectively managing risk and cultivating a disciplined mentality, traders can find their way the complexities regarding the Forex industry with greater self-confidence and resilience. Building these skills will take time and exercise, but they usually are vital for accomplishing consistent profits and even long-term success in the world regarding forex trading.