The Significance of Professional Liability Insurance vs Bonding

Introduction

In today's dynamic business landscape, understanding the nuances of risk management is more critical than ever. Among the various tools available to businesses and professionals, two concepts often stand out: professional liability insurance and bonding. But what exactly are these terms, and why should you care? In this comprehensive article, we’ll delve into "The Significance of Professional Liability Insurance vs Bonding," exploring how each serves a distinct purpose in protecting against different types of risks.

The Significance of Professional Liability Insurance vs Bonding

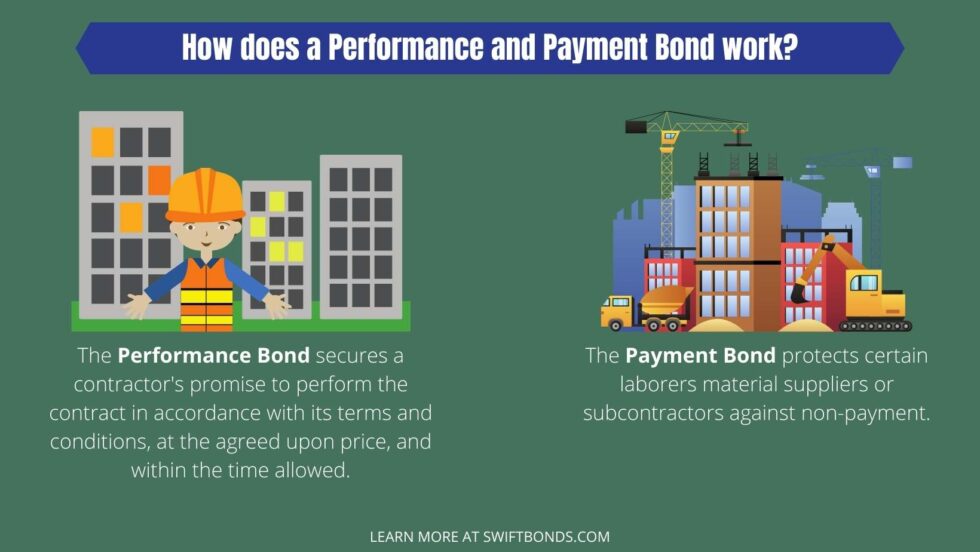

When it comes to safeguarding your business against potential financial pitfalls, both professional liability insurance and bonding play pivotal roles. However, they cater to different scenarios and concerns. While professional liability performance bonds for contractors insurance provides coverage for claims alleging negligence or inadequate work performance, bonding is more about guaranteeing that a job will be completed according to the contract specifications.

Understanding Professional Liability Insurance

What is Professional Liability Insurance?

Professional liability insurance, often known as errors and omissions (E&O) insurance, protects professionals from claims related to negligence or malpractice. This coverage is essential for service-based industries such as consulting, law, medicine, and finance. For example, if a client alleges that your advice led them to financial loss, this insurance would cover legal fees and any settlements.

Who Needs Professional Liability Insurance?

Not everyone needs professional liability insurance; however, many professions can significantly benefit from it. Here’s a list:

performance bonds Consultants: They provide advice that could impact their client's success. Healthcare Providers: Doctors and nurses face risks related to patient care. Accountants: Errors in financial reporting can lead to severe consequences. Real Estate Agents: Misrepresentation in property dealings can result in legal action.

Key Features of Professional Liability Insurance

Coverage for Legal Fees

One significant advantage of professional liability insurance is its coverage for legal fees associated with defending against claims—even if those claims turn out to be unfounded.

Protection Against Settlements

If a claim leads to a settlement or judgment against you, this type of insurance can cover those costs as well—saving you from hefty financial losses.

Limitations of Professional Liability Insurance

While it offers robust protection, professional liability insurance has its limitations:

It typically does not cover intentional wrongdoing or criminal acts. Policies may have exclusions based on specific circumstances or industries.

Understanding Bonding

What is Bonding?

Bonding is essentially a guarantee that certain obligations will be fulfilled as per the contract terms. It's commonly used in construction but can apply across various sectors where trustworthiness is paramount.

Types of Bonds

Contract Bonds: Ensures project completion according to contract specifications. License and Permit Bonds: Required by government agencies before granting licenses. Fidelity Bonds: Protects against employee dishonesty.

Who Needs Bonding?

Certain industries require bonding due to regulatory requirements or to instill confidence in clients:

Construction Companies Service Providers (e.g., janitorial services) Financial Institutions (for employee-related risks)

Key Features of Bonding

Guaranteed Performance

Bonds guarantee that a contractor will fulfill their obligations under the contract terms—offering peace of mind for clients.

Financial Security

Should the bonded party fail to meet contractual obligations, the bond ensures compensation up to the bond limit—protecting clients from potential losses.

Limitations of Bonding

Bonding also has certain limitations:

It does not cover mistakes made during project execution unless specified. Claims must be filed within strict timelines outlined by the bond agreement.

Comparative Analysis: Professional Liability Insurance vs Bonding

| Feature | Professional Liability Insurance | Bonding | |-----------------------------|---------------------------------------|----------------------------------| | Purpose | Covers malpractice/negligence claims | Guarantees contract fulfillment | | Coverage | Legal fees & settlements | Project completion | | Applicability | Service-based professions | Construction & service industries | | Financial Protection | Yes | Yes | | Limitations | Excludes intentional wrongdoing | Limited scope based on contract |

Why Choose One Over the Other?

Choosing between professional liability insurance and bonding depends on your profession's nature and specific risks involved:

If you're providing advice or services where mistakes can lead to significant harm or loss, opting for professional liability insurance would be wise. On the other hand, if you're involved in contracting work where performance guarantees are crucial for securing projects, bonding should be your focus.

Frequently Asked Questions

1. What’s the primary difference between professional liability insurance and bonding?

The main difference lies in their purposes: professional liability insurance protects against claims arising from negligence or malpractice while bonding guarantees that contractual obligations will be met.

2. Do I need both professional liability insurance and bonding?

It largely depends on your industry and specific circumstances; many businesses find value in having both forms of protection as they address different risks.

3. How much does professional liability insurance cost?

Costs vary widely based on factors such as industry risk level, coverage limits desired, and business size—on average ranging from $500 to $5,000 annually.

4. Can I get bonded without being insured?

Yes! You can obtain bonding independently; however, having both provides comprehensive protection for your business operations.

5. What happens if I make a mistake covered by my policy?

If you have professional liability insurance and receive a claim due to an error or omission within covered parameters, your insurer typically defends you at no additional cost up until policy limits are reached.

6. Is it mandatory for contractors to have bonds?

Many jurisdictions require contractors to obtain bonds before allowing them to bid on projects—fostering trust between clients and service providers.

Conclusion

Understanding "The Significance of Professional Liability Insurance vs Bonding" is crucial for any entrepreneur navigating today's complex business environment. Both tools serve vital functions in risk management but cater to different needs within diverse industries. While one provides protection against negligence claims associated with providing services—the other ensures contractual obligations are fulfilled while safeguarding clients' interests.

For professionals considering their options regarding risk management strategies—consult with experts like Western Surety Company who can guide you through selecting appropriate coverage tailored specifically for your unique situation! Ultimately protecting yourself means thriving amidst uncertainties while confidently delivering exceptional service!