Equity Analysts: Interpreting Market Trends for Your Benefit

In the rapid world of finance, understanding market movements can seem like trying to navigate a maze without a map. Equity research analysts play a crucial role in this field, providing insights and projections that help investors make knowledgeable decisions. By examining company performance, market conditions, and financial indicators, these specialists offer a more transparent view of what is ahead, enabling individuals and institutions alike to take advantage of new opportunities.

For those looking to achieve an edge in their investment strategies, utilizing the knowledge of equity analysts can be a game changer. With their profound understanding of economic metrics and trends, these specialists decode intricate market events, translating intricate data into actionable insights. Whether you are a seasoned investor or a newcomer, collaborating with equity analysis specialists can help you navigate unpredictabilities and identify potential areas for growth, making your financial journey more knowledgeable and potentially more beneficial.

Grasping Equity Evaluation

Equity analysis is a critical method that entails evaluating the fiscal health and performance prospects of publicly traded firms. Evaluators use various approaches to analyze a company's shares, including fundamentals and technical evaluation. Fundamental analysis focuses on financial reports, economic conditions, and industry trends, while technical evaluation emphasizes price changes and trading volumes. By integrating these approaches, equity evaluators can provide insights into the future performance of a stock.

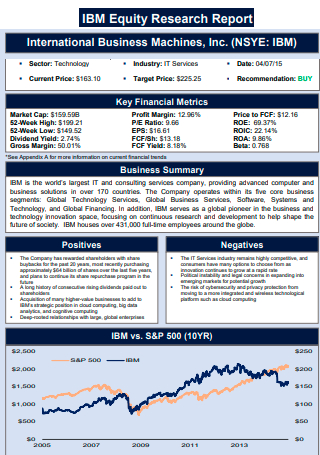

Stock analysts consider multiple factors when conducting their analysis. equity research report investigate a company's sales increase, profitability, and liquidity, as well as broad economic signals that could affect the company's performance. In addition, evaluators evaluate competitive standing within the industry, assessing how a company measures up against its competitors. This holistic approach allows investors to formulate knowledgeable decisions about buying, holding, or selling shares.

The primary goal of equity evaluation is to establish the intrinsic value of a company's stock. Evaluators generate price targets for stocks based on their results and provide advice to investors. By leveraging the expertise of equity analysis experts, investors can gain a better understanding of market trends and capitalize on investment prospects. This insight can be invaluable in navigating the intricacies of the financial markets and improving investment approaches.

Key Metrics for Market Trends

Understanding crucial figures is essential for equity analysts in decoding market dynamics. One of the primary metrics is earnings per share. This statistic indicates a company's financial performance on a per share basis, allowing analysts to evaluate the earnings of multiple companies within the same industry. A continuously growing EPS can point to a healthy financial position, attracting investors and affecting stock prices positively.

Additionally, a key metric is the price-to-earnings ratio, or P/E ratio, which provides insight into how much investors are willing to pay for a single dollar of earnings. A significant P/E ratio may suggest that the market forecasts future growth, while a reduced P/E may indicate an undervalued stock. Analysts commonly use this ratio in conjunction with the company's past performance and industry averages to make informed investment decisions.

Lastly, the equity return, is an crucial measure that demonstrates how effectively a company is leveraging its equity to generate profits. A high ROE indicates that the company is efficient at providing returns for shareholders, while a low ROE can signal concerns about its operational effectiveness. By examining these metrics, equity analysts can deliver meaningful insights into market trends and help investors make informed investment decisions.

The Importance of Analysts in Stock Market Investment

Equity analysts play a crucial role in guiding investors manage the complexities of the equity market. Their chief responsibility is to analyze the financial health of businesses, making informed predictions about prospective performance based on extensive research and analysis. By examining financial reports, market fluctuations, and industry changes, these experts provide invaluable insights that can help investors make wise decisions.

Additionally, equity analysts often produce detailed reports that summarize their findings and offer suggestions on whether to purchase, divest, or hold stocks. These reports serve as important resources for individual investors and corporate clients alike, enabling them to grasp the underlying factors affecting stock prices. Moreover, analysts frequently engage in dialogues with company management and industry leaders, providing them with a better understanding of market dynamics and prospective risks.

In conclusion, the skills of equity analysts can greatly enhance an investor's ability to capitalize on market opportunities. By employing their analytical skills and market knowledge, investors can more effectively situate themselves for success. This collaboration between analysts and investors fosters a well-informed investment environment, leading to potentially better financial outcomes.