Why It’s Crucial to Understand Your Policy Before Signing with an Insurer

Introduction

Understanding your insurance policy is not just a good idea; it’s absolutely vital. Many people rush through the process of signing up for insurance without fully comprehending the terms, conditions, and implications of their policies. This can lead to costly mistakes down the road. By taking the time to read, interpret, and ask questions about your policy, you can protect yourself from unexpected expenses and ensure that you're adequately covered for life's uncertainties.

In this article, we will delve deep into the importance of understanding your insurance policy before signing with an insurer. We'll explore various aspects such as types of insurance, common pitfalls, essential terminologies, and how to communicate effectively with your insurer. Whether you are dealing with health insurance, auto insurance, or any other type of coverage—including policies from insurance bond companies—this comprehensive guide aims to empower you with knowledge.

Why It’s Crucial to Understand Your Policy Before Signing with an Insurer

When it comes to financial protection and peace of mind, understanding your insurance policy is key. Policies can be complex documents filled with jargon that may not make sense at first glance. However, signing a policy without comprehension can lead to severe consequences.

The Risks of Ignorance in Insurance Policies

Underinsurance: One major risk is being underinsured. If you don’t fully grasp what your policy covers—or doesn’t cover—you might find yourself in a situation where you're financially vulnerable when disaster strikes.

Overinsurance: Conversely, misunderstanding your needs can lead to overinsuring yourself. You may end up paying higher premiums for coverage that exceeds what you actually require.

Claims Denied: A lack of understanding could also result in denied claims due to misinterpretations or assumptions about coverage limits.

Increased Stress: The stress associated with navigating unexpected costs can take a toll on mental well-being.

Understanding your policy ensures that you’re prepared for whatever life throws at you—be it accidents, natural disasters, or health emergencies.

Common Types of Insurance Policies Explained

Health Insurance

Health insurance is designed to cover medical expenses. Understanding co-pays, deductibles, and out-of-pocket maximums is crucial.

Auto Insurance

Auto insurance protects against financial loss in case of accidents. Familiarizing yourself with liability coverage versus collision coverage is essential.

Homeowners Insurance

Homeowners insurance protects against damages to one’s home. Knowing what natural disasters are covered versus excluded is vital.

Life Insurance

Life insurance provides financial support after one's death. Different policies (term vs whole life) serve different needs.

Business Insurance

Business insurance protects against risks associated with operating a business. Understanding general liability versus professional liability is important for entrepreneurs.

Key Terminologies You Should Know Before Signing

Premium

Your premium is the amount you pay periodically (monthly or annually) for your coverage.

Deductible

A deductible is the amount you must pay out-of-pocket before your insurer starts covering costs.

Coverage Limit

This refers to the maximum amount an insurer will pay for a covered loss under your policy.

Exclusions

Exclusions are specific conditions or circumstances that aren’t covered by your policy.

How To Effectively Communicate With Your Insurer?

Effective communication can significantly enhance your understanding of policies:

Ask Questions: Never hesitate to ask questions about terms or clauses that confuse you.

Seek Clarification: If something seems unclear even after asking questions, request examples or further explanations from your agent.

Take Notes: Document important points during conversations for future reference.

Review Documentation: Always review any materials sent by your insurer thoroughly before making decisions.

The Importance of Reading Fine Print in Insurance Contracts

The fine print often contains critical information regarding limitations and exclusions that could affect claims later on:

| Key Points | Description | |------------|-------------| | Exclusions | Specific situations not covered by the policy | | Riders | Additional coverage options available | | Renewal Terms | Conditions under which the policy may be renewed |

What Happens When You Don't Understand Your Policy?

Claims Process Complications

Misunderstanding terms can complicate claims processes leading to delays or denials.

Financial Consequences

Unexpected out-of-pocket expenses may arise if you're unaware of limitations within your coverage scope.

How Insurance Bond Companies Fit In?

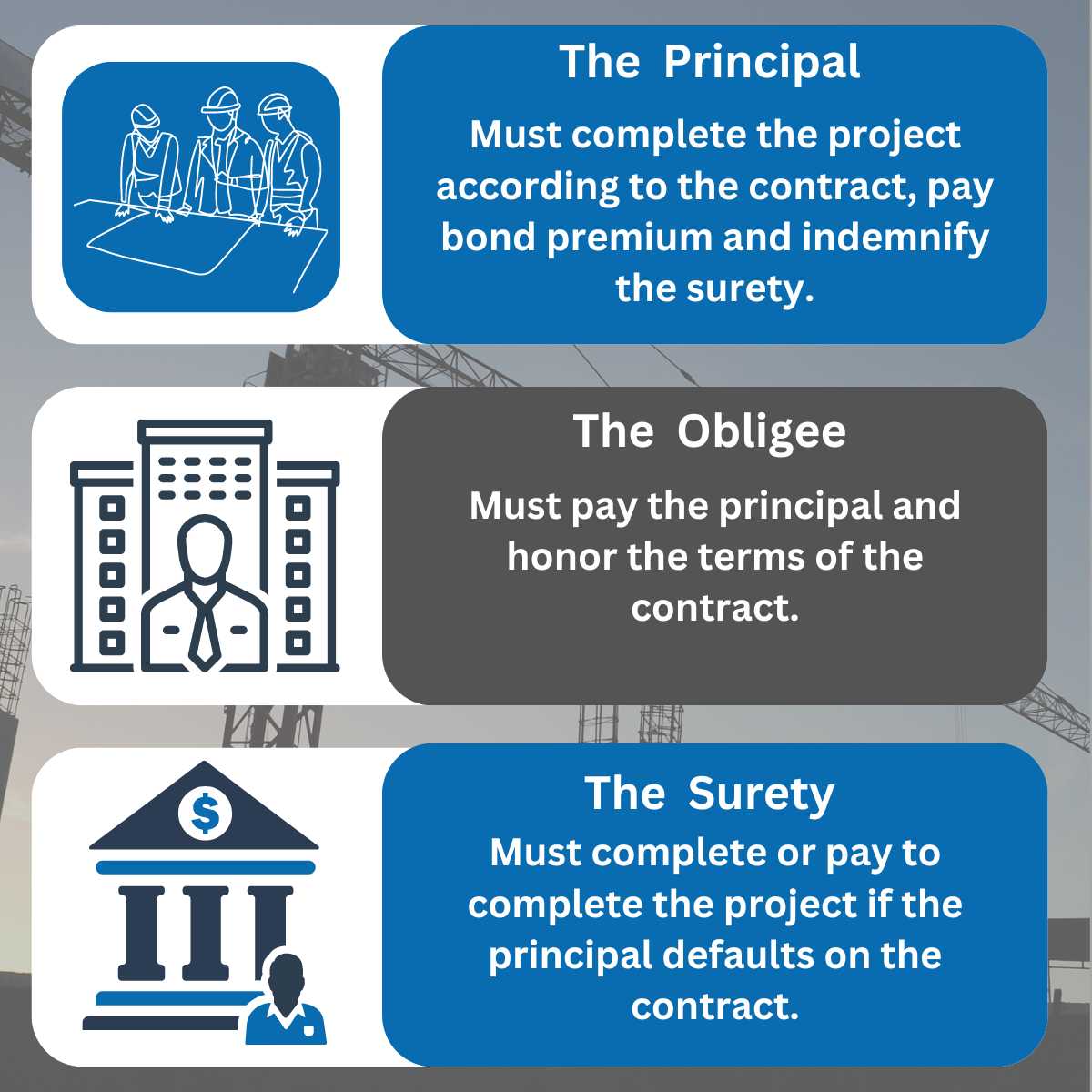

Insurance bond companies provide guarantees that certain obligations will be fulfilled according to contract terms.

They offer bonds necessary for various industries such as construction. Understanding these bonds helps businesses mitigate risks effectively while ensuring compliance with legal requirements related to performance and payment guarantees.

FAQs

What should I do if I don't understand my policy? Reach out directly to your insurance agent or company representative for clarification on confusing aspects of your policy. Are there resources available online? Yes! Many reputable organizations offer guides and glossaries explaining common insurance terminology. Should I consult a lawyer before signing? If significant amounts are involved or if you're unsure about legal jargon in contracts, consulting a lawyer can be beneficial. Do all insurers have similar policies? Not necessarily; policies vary greatly among insurers based on factors like location and specific coverage types offered. Is it normal for agents not to explain every detail? explaining surety bonds While many agents aim for clarity, some may gloss over technical details due to time constraints; it's essential for clients to advocate for thorough explanations. What mistakes do people commonly make when looking at their policies? Common mistakes include overlooking exclusions or assuming coverage where none exists due to lack of understanding.

Conclusion

In summary, understanding your insurance policy before signing with an insurer cannot be overstated—it’s crucial! Being informed empowers you not just as a consumer but also as someone who wants genuine protection against life’s unpredictabilities. From knowing key terminologies like premium, deductible, and coverage limit—to engaging effectively with insurance bond companies, each aspect plays a pivotal role in securing peace of mind regarding financial responsibilities in times of crisis.

By investing time in comprehending what you're signing up for—be it health insurance or bonding agreements—you'll ultimately save yourself from unforeseen challenges down the line and ensure you're adequately protected when it matters most!