Understanding Home Loans: A Detailed Computational Manual

Grasping home loans often can feel as if navigating a maze, with complex terms and numerous figures that seem overwhelming. Many potential homeowners find themselves asking, what’s actual loan expense? This inquiry is essential, yet difficult to respond to in the absence of the proper tools. Thankfully, a mortgage calculator is able to streamline this procedure, offering insight on how loans, interest rates, and various factors add up to your total financing.

In this instructional, we will outline the steps needed to calculate your true mortgage, ensuring you are equipped to make wise financial decisions. From understanding principal and interest to factoring in taxes and insurance, we will explain each element of the mortgage calculation. By the end, you will not just know how to use a mortgage calculator but also be confident in grasping the actual cost of your mortgage. Let us embark on this path toward financial literacy as a team.

Understanding Home Loan Fundamentals

A mortgage is a financial agreement exclusively used to purchase real estate. It entails borrowing funds from a lender, commonly a financial entity or lending organization, that must be repaid with finance charges over a defined time frame. The property purchased acts as guarantee, meaning if the homebuyer neglects to make payments, the financial institution can take possession of the property through repossession.

When considering a home loan, it's essential to understand critical concepts such as principal, finance charges, and duration. The loan amount is the amount taken, while finance charges is the cost of taking on that principal. The duration refers to the length of duration you have to repay the debt, which usually ranges from fifteen to 30 years. A lengthier term generally yields lower installments but higher interest accrued over the life of the loan.

Mortgage payments typically include the combination of principal and interest, and might also comprise other expenses such as property taxes, homeowner's insurance, and private mortgage insurance. To help prospective homebuyers evaluate cost-effectiveness, many use a mortgage calculator, which provides a rapid estimate of monthly payments based on the loan amount, finance rate, and duration. Grasping these fundamentals will enable you to make informed decisions when selecting a home loan.

How to Use a Mortgage Calculator

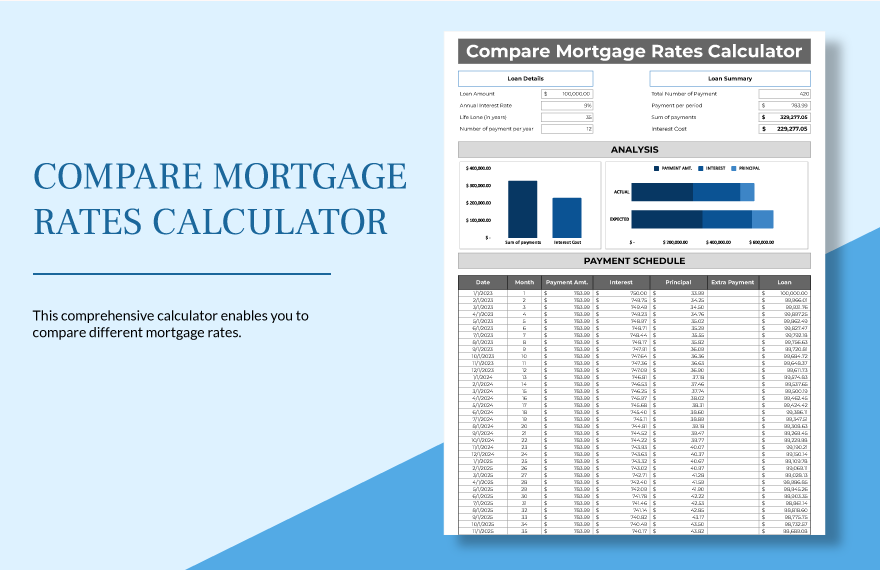

Using a mortgage calculator might streamline the difficult process of figuring out your monthly payments. Begin by typing in hipotecalc.com , which is the amount you mean to borrow. Many calculators will also ask for your down payment percentage, which diminishes the total amount financed. By inputting these figures, you can get a clearer picture of your loan amount.

Next, input the interest rate and loan term. The interest rate affects how much you pay over the life of the loan, so it's crucial to apply an accurate rate based on your credit score and market conditions. The loan term, typically spanning from 15 to 30 years, may also impact your monthly payment and the total interest paid over time. This information aids you understand the overall costs associated with your mortgage.

Once inputting all necessary data, the calculator creates an estimate of your monthly payment, which includes principal and interest. Numerous calculators also offer insights into property taxes, insurance, and any private mortgage insurance that may apply. This comprehensive view assists in budgeting and deciding if a specific mortgage matches your financial situation.

Interpreting Your Results

When you have submitted all the required data into your mortgage calculator and received your results, it's vital to take a moment to analyze what those numbers indicate. The calculator will generally provide you with your recurring payment amount, which includes both principal and interest. However, you may also see calculations for property taxes, homeowner's insurance, and possibly private mortgage insurance if your down payment is less than 20 percentum. Understanding these elements is essential for getting a full picture of your periodic financial obligation.

Then, consider the total cost you'll pay over the duration of the loan. This number can often be alarming, as homeowners may realize that they end up shelling out significantly more than the starting loan amount due to interest accrual over time. Pay attention to how various loan terms, such as 15 years compared to 30 years, can greatly affect this total amount. Briefer terms typically mean greater monthly payments but decreased total interest paid, while prolonged terms offer smaller payments but can lead to considerably more overall interest.

Ultimately, reflect on how your calculated mortgage fits into your overall financial picture. Review your budget to see how the estimated monthly payment corresponds with your income and various expenses. It's essential to ensure that you can comfortably handle the mortgage payments along with additional obligations. This holistic view will help you make educated decisions about the appropriateness of the mortgage for your personal situation.