Which is the top Cardano Stake Pool to invest in

Introduction

Making a decision on a stake-pool could be very difficult for newcomers in the Cardano community due to the fact that they are not aware of the numerous charges, metrics, as in addition to performance metrics. This guide will facilitate the process of selecting a stake-pool by presenting the main aspects to consider when deciding Cardano stake-pools.

Understanding Cardano Staking

It is crucial to acquire a solid understanding of Cardano Staking prior choosing which stake pool to go with. It's a feature of the Cardano network Staking and involves the transfer the majority (or all) part of ADA (Cardano's primary currency) into stake pool. this helps to protect the safety of the network as well as rewarding our customers!

What is Staking doing in Cardano?

The Cardano stakestaking strategy is based on an algorithm known as the Ouroboros consensus system that picks stake pools in accordance with how much stake each pool holds. The greater the stake you allocate to one pool, the better chance of being picked to make blocks (and possibly increase your reward). When you put more stakes to a pool it is more likely that it will be able to create blocks. The reward your receive is greater because you have more stakes to the pool!

The importance of staking

Cardano's system of decentralization is at risk. By donating ADAs to stakes-taking decreases the possibility of attacks and boosts the level of protection and its governance.

Certain Factors that You Need to Take into The Account

Pool Performance

The success of your stake pool is one of your primary considerations to take into consideration while making investment decisions. A pool that is performing effectively will be more capable in generating blocks that are new, so you are more likely in receiving a reward. There are numerous Staking platforms as well as community sites using which you are able to confirm this.

-

Block production. What is the total amount of blocks that are created by this pool?

-

You can always access the pool in the online pool.

-

Decreasing Amounts: A change in the delegated ADA may be a sign of the credibility.

Additional Performance Indicators

-

Relay Nodes Multi-node Pools can provide more connectivity, as well as better resilience to faults.

-

Historical Performance is usually a reliable indicator of results in the future. However should not be based on completely.

Fees for Pools

The fees are set by each stake pool to meet operations and generate an income. Reductions in reward amounts prior to distribution to delegated parties will diminish overall returns in the same manner. To maximize your earnings, you should know their fees structure.

There are two types of fees:

-

Fixed Fee: A set value that will be subtracted from the reward total

-

Variable Fee: A fee depending on the percentage of tips

Fee Comparison

Should you be thinking of enrolling in a pool, take a look at prices charged by it against other pools. Prices that are more costly can mean superior security and performance that justifies the cost.

Pool Saturation

How to Determine Saturation

Because ADA devices are part of a single pool, saturation could occur when there are a lot of systems assigned to the pool and can affect the network positively. The result is lower earnings as well as a lower potential for income. There is a level of saturation that the pool that you have chosen should be frequently checked. It is also recommended that you adjust your pool in the event of a need, for example, shifting or delegating the more ADA when needed.

-

Use Cardano Staking Platforms. They typically are equipped with software to measure the amount of saturation in the pool.

-

community-driven sites: typically provide information from other members of the community.

Saturation Alerts

Alert systems are available on certain platforms, which inform that your account has reached its limit, allowing to make decisions about the best way to divide stakes and efficiently. Be proactive about investing the money you have earned using these tools!

Incorporating your money into one pool is not an optimal option. By diversifying your investments into multiple pools can reduce the chance of a saturated pool, inefficiency, or security issues.

Multiple Small Pools By spreading this work among several smaller pool sizes this makes the pools more decentralized and produce greater returns.

Diversifying fees is another approach to boost profits is diversifying pools.

There are many advantages of having a diverse portfolio.

Diversification may be an option for you to shield yourself in the event that one of the pools you opt for isn't working or is facing difficulties. Diversification also allows individuals support diverse charitable and environmental initiatives by using various pools.

Options for Wallets and Security Measures

A variety of different wallet types

If you're looking to safeguard yourself and your ADA card, choosing the appropriate wallet could be the biggest different. There are several different wallets offered by Cardano such as Daedalus and Yoroi the wallets that will meet all your specifications, but remain secure.

-

Daedalus Wallet: the official account of Cardano, Daedalus offers node functionality and a stake centre with multiple stake pools are accessible for download of all Cardano blockchain information. This will ensure absolute security.

-

Yoroi wallet Yoroi makes a very simple and lightweight wallet created to ease Cardano Staking. Yoroi could be considered an extension on a web browser that makes it simpler to use for daily transactions unlike Daedalus.

Hardware wallets

If you're looking for security, hardware wallets like Ledger and Trezor offer a level of security because their recovery codes are encrypted and stored off-line, safeguarding them from cyber-attacks.

Checklist to to Secure Pools

-

Be sure the website used by the pool has HTTPS in order to make sure that information is secured.

-

In the same way it is imperative to ensure that the Recovery phase is kept secure, as losing access the Recovery phase may result in losses of funds.

-

When using multi-signature wallets, transactions can only be valid when multiple signatures can be verified.

Stake Pool Operators and Their Functions

What is to be looking for in the Stake Pool Operator

Through managing nodes that generate blocks for the Cardano blockchain Stake pool's owners are a key component of the Cardano network. An experienced stake pool administrator could make a huge difference on the efficiency of the all stake pools and the rewards earned by delegators.

-

Experience: What's the duration that the owner of the pool had been running it?

-

Transparency: Do your have regular reports, as well as regular membership in the Cardano community of this business?

-

Infrastructure Do they have an infrastructure that could provide continuous and stable service? Does how to choose a cardano stake pool interfere with production?

Community Engagement

Employers who engage and transparently in their local communities are much more likely to be more reliable, as well as more likely to react quickly and immediately to the questions of the delegator or concerns about operations.

Start Earning Your First Rewards Today

The Epochs of Understanding and the Rewards

Once you have seen your very first reward appear, is one those moments that are the most exciting of Cardano stake-taking! Make sure you are aware that it might take days after the delegate until you start to see the results. After that the rewards should begin to accumulate right now! In the cardano Epoch will last for five days. In time, rewards accumulate after each event has been completed.

-

Epoch. Cardano that means units with five days for which stake pools have been chosen to make blocks.

-

Early Rewards: you will expect your first payment upon the completion of the second Epoch following the delegation.

-

Rewards Received: It's vital to remember that the amount you receive is contingent upon certain factors, like what happens to your stake pool as well as the amount ADA that you've gifted away.

A Reward-Distribution Mechanism

If you've finished each one your reward is instantaneously added to your stake account The procedure is simple and effortless.

Legal and Regulatory Compliance

Compliance Checklist

The decision to invest in a stake pool within the framework of all relevant statutes and rules is critical to stay on top of the evolving regulatory landscape. In order to evaluate possible investment opportunities, it's essential to conduct thorough research on the record of compliance for the company before taking any final decisions.

-

KYC/AML Policy: Prior accepting new clients to their pools, some pools need to be aware of Your Customer (KYC) and Anti Money Laundering (AML) checks.

-

A Transparency Report One of the main things to be doing is to select pools where the integrity and consistency of their operations are frequently demonstrated by their transparent annual reports.

-

Legal Jurisdiction: It is essential to keep track of the position of stake-pools as they could influence the conditions for the regulation.

Community and the Power of Community

Take your time and assure that the pool's laws are met. When you're doing this, you'll be able to avoid legal complications that could adversely impact your staker's rewards as well as your operation of the pool.

Social proof and evidence from the community

Community Engagement Metrics

The amount of help a project gets from its supporters will determine it's credibility as well as its performance. Cardano stake pools that are active community tend to be more transparent and stable.

-

Social Media Participation: The members of stake pools maintain a strong social media presence through which they interact on a regular basis with their networks.

-

Forums and Discussions: learn about honest opinions regarding stake pool options on Reddit as well as the Cardano forum for community members.

-

Review and testimonials: Customers with ADAs assigned to them of their ADAs at the time of pool use could share valuable information about the pool's effectiveness and reliability.

Community and the Power of Community

Through collaboration and engagement with stakeholders. Through collaboration and being involved in the stakeholder community, beneficial feedback could be gained from projects. It can be utilized into the process, and concerns can be addressed.

Advanced Tools and Analytics

The Tools You Should Consider

Strategies for stakes are refined by using sophisticated tools as well as techniques once you've established a foundational understanding.

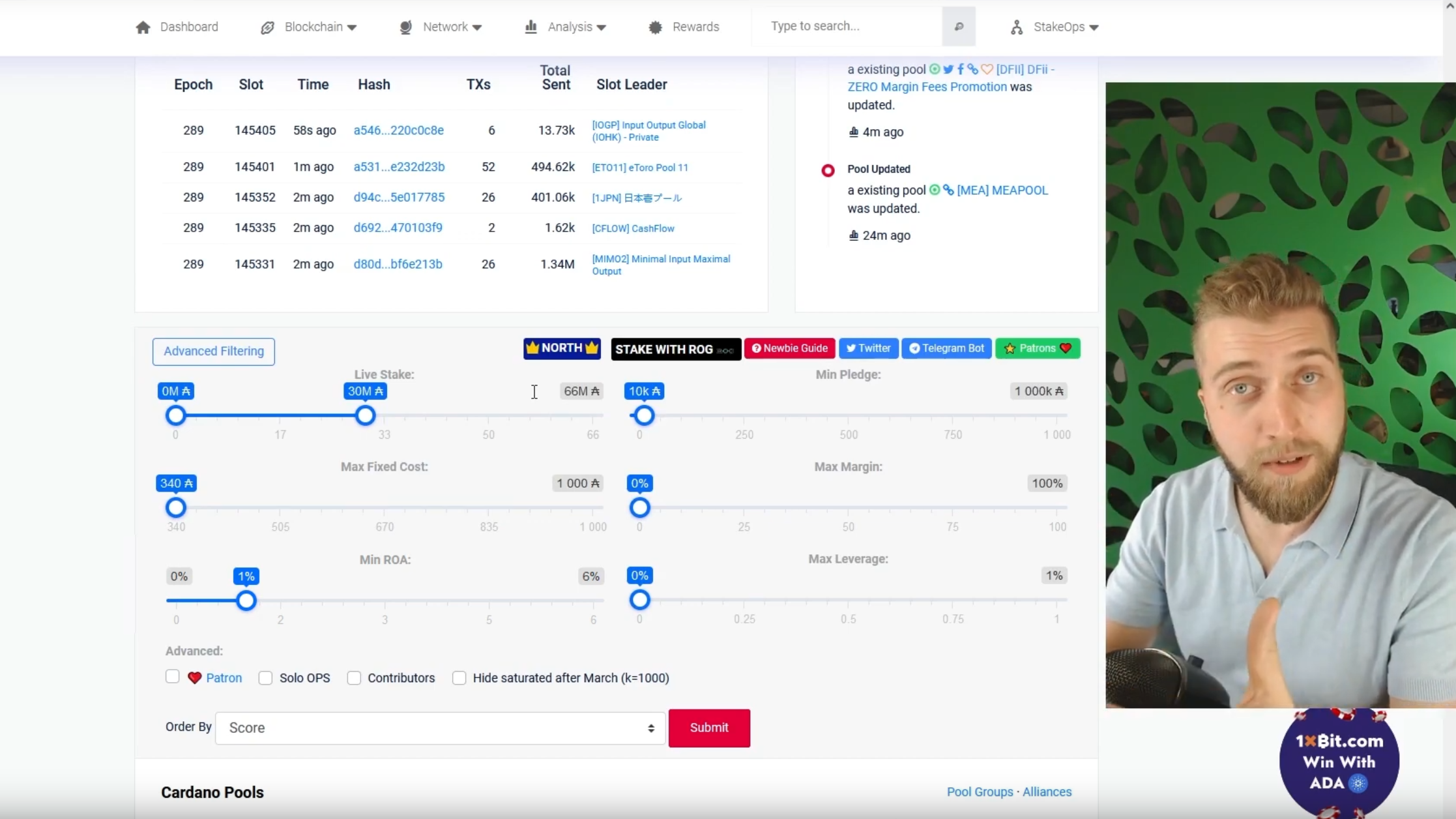

-

PoolTool: This website provides live information and statistics on Cardano stake pools.

-

AdaPool Control and monitor stake pools within Cardano with the help of AdaPools with improved effectiveness as well as the tracking of rewards.

Analytics to Monitor

-

Return on stake (ROS) In using this metric, you are able determine what returns that your stakes are likely to produce annually in terms of returns.

-

Live Stake and not. Active Stake: A stake that lives is the amount of ADA and is allocated to usage in the pool. In a non-active stake, it is the amount that was taking place at the date of an event.

Risk and the Mitigation of it

Potential Risks

While Cardano Staking has a fairly moderate risk compared to different investments in crypto. It's still vital that investors remain attentive to the risks they could face and techniques to limit the risk.

-

Cardano does not employ the cut-and-slash method. So your staked ADA won't be reduced for pool-related behavior.

-

Pay attention to the degree of water saturation within your pool because a saturated pools can reduce return.

Mitigation Strategies

-

Watch regularly and monitor what happens to your staked rewards and pools.

-

It is important to select trusted platforms. Ensure that your stakes have been placed on secure platforms to prevent fraud.

Aspects of technicality in Cardano Staking

Ouroboros Explained

The knowledge of Ouroboros will allow you to take informed decisions regarding Cardano stakes. It is a Cardano exclusive consensus mechanism, which ensures the security of the network, as well as its effectiveness.

-

Slot leaders in cardano blocks are established by slot leaders during these times and they are divided into epochs and slot leaders.

-

Randomness Ouroboros algorithm creates random numbers through an algorithm that is encrypted to make sure that fair voting is held.

-

Game Theory Cardano employs the game-theory approach in efforts to increase participation in a way that is fair and builds networks that are able to stand up to future attacks.

Technical Foundation

Through peer-reviewed and peer-reviewed research, and its official operating procedure, Cardano is considered to be one of the safest Blockchain platforms. Making informed choices when has to do with staking your currency is much simpler when you are aware of the technological aspects included in Cardano. Cardano ecosystem.

The Economic Benefits of Cardano Staking

Understanding the Economic Value of Cardano Staking

It is important to comprehend the motivations behind economic activity so you're aware about the opportunities and dangers associated with many stakes.

-

Monetary Policy: There's a very limited number of 45 billion ADA tokens available via Cardano with a split in period of time according to your monetary policy. What the stakes' benefits are dependent on these monetary policy choices.

-

Staker Rewards Part of Staker rewards will be donated to a fund that will help to finance the future Cardano advancement initiatives.

-

What happens to inflation and deflation rates? when the new ADA tokens get put in circulation will have immediate and quantifiable effects on the value of stakes.

Economic Models

To establish an environment that allows all to participate, the model of economics used by Cardano looks at factors like inflation and Deflation when it comes to Treasury funds.

The Governance Processes of Cardano Staking

ADA holders may influence how they invest and plan Cardano's future. Cardano through its strong management system.

-

Project Catalyst Democratic open governance model Cardano has been testing permits users of ADA for voting and to suggest the projects they want to work on. As time passes, the concept of On-Chain Governance as well smart contracts can be applied to design more sophisticated governance models.

-

Governance is essential Governance is essential for the long-term viability in any decentralization-oriented blockchain such as Cardano. Being a part of the governance allows you to have a say in the direction it will take in the future as well as play a role in its improvement.

Evaluation Criteria to Assess Stake Pool Reliability

You must consider ways to assess the legitimacy stake pool to ensure sustainable success in betting.

-

Historical Performance: Evaluate the performance of a pool at multiple points to test its reliability.

-

Tech Stack Investigating the technologies used to build its stack of technologies can provide information about the reliability issues and performance in stake pool.

-

Geographic distribution: The issue of latency encountered by servers situated in multiple locations are usually less by splitting the servers into diverse geographic regions.

Evaluation is a must and it's important to keep it going

Continuous Analysis In the midst of all the shifts happening in the crypto market the environment continues to quickly change. Certain things thought to be equally reliable in the past may not be so reliable in the future. For you to succeed in stakes it is imperative to regularly be evaluating your efforts and applying your diligence and determination to become profitable.

Tax implications of Staking Reward

Tax Factors

Knowing the tax consequences when you decide to put the money in Lucre Rewards is vital in the event in which you're aware they could count as taxable income in various countries.

-

Tax Rates Tax rates can depend on where you are located.

-

Reporting: Some nations require any cryptocurrency earned to be reported as income.

-

Tax events: Should be legally recognized in your country, for example, if it's tax-deductible for you to trade or make cash rewards?

Tax Planning

Additionally, tax planning strategically can ensure strictness of local law. Consult with an expert on tax issues in regard to cryptocurrency.

Conclusion

Finding out an appropriate Cardano stake pool is a challenge and rewarding, based on all the variables that need to be considered. Reviewing the performance of your pool, fees and safety, and involvement in your community helps you to make the right decision on your money that's in sync with your desired outcomes. Making sure you are up to date on cardano's latest information and trending issues will boost the chances of success this investment strategy since it's continually changing.

When you've read this full guide and you'll gain the knowledge to navigate the thrilling and lucrative market that is Cardano stakes. This knowledge will assist increase the amount of money you reap from investing while making a contribution to decentralizing the system and secure the Cardano system's decentralization capabilities as well as securing it regardless of whether one is a novice or an experienced crypto-currency enthusiast.