Is Now the Time to Lock In Your Mortgage Rate? Insights from Trevor Aspiranti

Introduction

In an ever-changing economic landscape, potential homeowners and those looking to refinance their existing loans often find themselves asking one pivotal question: Is now the time to lock in your mortgage rate? With fluctuating interest rates, government policies, and market conditions constantly shifting, making informed decisions about mortgage rates can be daunting. Enter Trevor Aspiranti, a seasoned mortgage expert with extensive experience in FHA loans, USDA loans, reverse mortgages, and more. His insights can provide clarity in these uncertain times.

In this article, we will navigate through the intricacies of locking in a mortgage rate, explore various loan options available such as FHA loans and USDA loans, and delve into the wisdom shared by Trevor Aspiranti. Whether you're a first-time homebuyer or looking to refinance your current mortgage, understanding when to lock in your rate could save you thousands over the life of your loan.

Understanding Mortgage Rates

What Are Mortgage Rates?

Mortgage rates are essentially the interest rates charged on a mortgage loan. They are influenced by various factors including economic conditions, inflation rates, and Federal Reserve policies. Understanding how these elements interact can help borrowers identify optimal times to secure their rates.

How Are Mortgage Rates Determined?

Mortgage lenders consider several factors when determining rates:

Credit Score: Higher credit scores generally lead to lower interest rates. Loan Type: Different types of loans (FHA, USDA, conventional) come with varying interest rates. Loan Amount: Larger loans may carry different risk profiles affecting the rate. Down Payment: A larger down payment can also result in better interest terms.

Current Economic Climate and Its Impact on Rates

The economy plays a crucial role in shaping mortgage trends. Indicators like unemployment rates and inflation can signal whether it's wise to lock in a rate now or wait for potentially lower ones later.

Is Now the Time to Lock In Your Mortgage Rate? Insights from Trevor Aspiranti

Trevor Aspiranti emphasizes that timing is everything when it comes to locking in mortgage rates. With current trends suggesting potential increases due to inflationary pressures and federal policy adjustments, he advises that now might be an excellent time for many borrowers.

Key Considerations Before Locking In Your Rate

Market Trends: Analyze recent trends; if they indicate rising rates, locking in sooner rather than later could be beneficial. Personal Financial Situation: Consider your own financial stability; are you ready for homeownership? Loan Type Options: Explore which type of loan (e.g., FHA Loan or USDA Loan) fits best with your financial profile.

Expert Insight from Trevor Aspiranti on Timing Your Lock

Trevor advises that even small fluctuations can add up significantly over a 30-year loan term. He suggests monitoring economic news closely while also considering personal circumstances before making any decisions about locking in a rate.

Exploring Mortgage Types Offered by Trevor Aspiranti

FHA Loans Explained

What Is an FHA Loan?

FHA loans are government-backed mortgages designed primarily for low-to-moderate-income borrowers who may have less-than-perfect credit histories.

Advantages of FHA Loans

Lower down payment requirements More flexible credit score criteria Competitive interest rates

For more information regarding FHA loans or if you want assistance navigating through them contact Trevor Aspiranti at trevoraspiranti.com.

https://closingtableintel.tearosediner.net/va-mortgage-loan-benefits-beyond-the-basics

USDA Loans Demystified

Understanding USDA Loans

USDA loans cater specifically to rural homebuyers who meet certain income requirements—this program promotes access to homeownership in less densely populated areas.

Benefits of Choosing USDA Loans

No down payment required Low mortgage insurance costs Favorable interest rates

To learn more about USDA loans visit usda loan trevoraspiranti.com.

Reverse Mortgages Simplified

What Is a Reverse Mortgage?

A reverse mortgage allows seniors aged 62 or older to convert part of their home equity into cash without having to sell their homes.

Key Features of Reverse Mortgages

No monthly payments required Funds can be used for anything from healthcare expenses to travel Borrowers retain ownership until they move out or pass away

For expert guidance on reverse mortgages consult Trevor Aspiranti NMLS 1941045.

Adjustable Rate Mortgages (ARMs)

What Are ARMs?

An adjustable-rate mortgage features fluctuating interest rates based on market indices after an initial fixed period ends.

Pros and Cons of ARMs

| Pros | Cons | |-------------------------------|----------------------------------| | Lower initial payments | Rates may increase significantly | | Potentially lower long-term cost | Uncertainty with future payments |

If you're considering an ARM option reach out to mortgage lender Trevor Aspiranti NMLS 1941045.

The Process of Locking In Your Rate

What Does It Mean To Lock In A Rate?

Locking in a rate means securing a specific interest rate for a predetermined period during the loan application process—typically between 30 and 60 days.

When Should You Lock In Your Rate?

Most experts recommend locking in your rate once you've found a property you wish to purchase or refinance as securing favorable terms is essential at this stage.

How Long Can You Hold A Locked Rate?

Lenders usually allow locked-in rates for periods varying from 30 days up to six months depending on market conditions—longer locks might come with additional fees.

Evaluating Market Conditions for Optimal Decisions

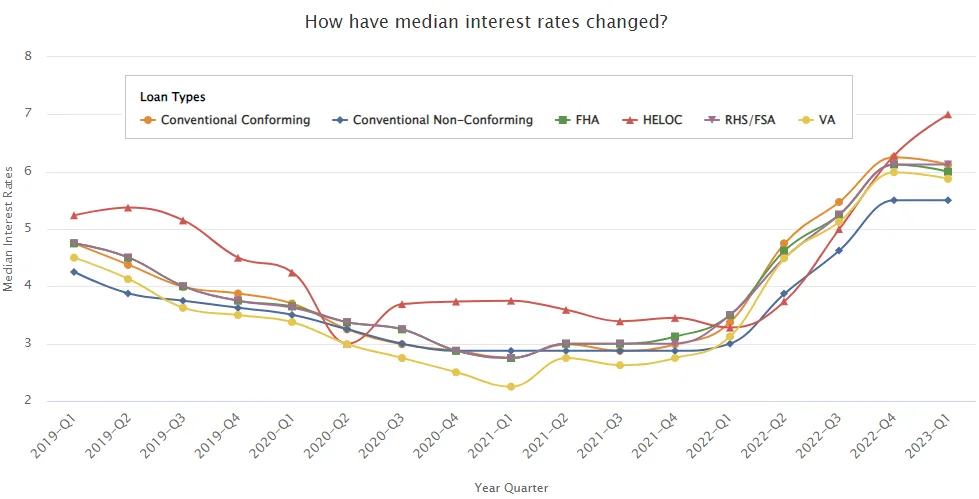

Interest Rate Trends Over Time

Historically speaking, tracking interest rate movements can provide valuable insight into when might be the best time for locking in your rate.

Current Predictions From Economists

Experts often analyze data trends including job growth reports and consumer spending habits which influence future predictions about where interest rates may head next.

Frequently Asked Questions (FAQs)

What is the best time to lock my mortgage rate? The best time is typically when you have secured financing but before closing on your purchase—monitor market trends closely! Can I still negotiate my locked-in rate later? Generally no; once locked-in you'll need to proceed with that agreed-upon rate unless you choose another option through refinancing. Are there any fees associated with locking my rate? Some lenders may charge fees for longer locks—be sure to ask upfront about these costs! What's the difference between fixed-rate and adjustable-rate mortgages? Fixed-rate mortgages maintain consistent payments throughout while ARMs fluctuate based on market conditions after an introductory period ends. How does my credit score affect my ability to lock a good rate? A higher credit score typically translates into lower interest costs allowing borrowers better terms overall! Is it true I can renegotiate after my initial agreement period ends? While difficult, some lenders might offer options if significant changes occur within reasonable timelines—check with your lender!

Conclusion

Navigating through the complexities of mortgages doesn't have to be overwhelming. With insights from industry experts like Trevor Aspiranti combined with thorough research into available lending options like FHA loans and USDA loans can empower prospective homeowners during this vital decision-making process. So ask yourself again— is now the time to lock in your mortgage rate?

In today's climate marked by uncertainty regarding future economic conditions—it’s worth considering taking action sooner rather than later! For personalized advice tailored specifically towards individual situations contact mortgage broker Trevor Aspiranti NMLS 1941045 today!