Navigating GST Calculations is Easy by using GSTCalculator

In the world of complex the tax system, Goods and Services Tax (GST) stands as an important element of the world's economic system. This value-added tax, levied on most goods and services for domestic consumption is an important resource for government agencies and an important consideration for companies as well as consumers. Amidst this intricate fiscal landscape, GSTCalculator.tax emerges as an essential tool that simplifies the daunting task of GST calculation.

Understanding GST and its global application

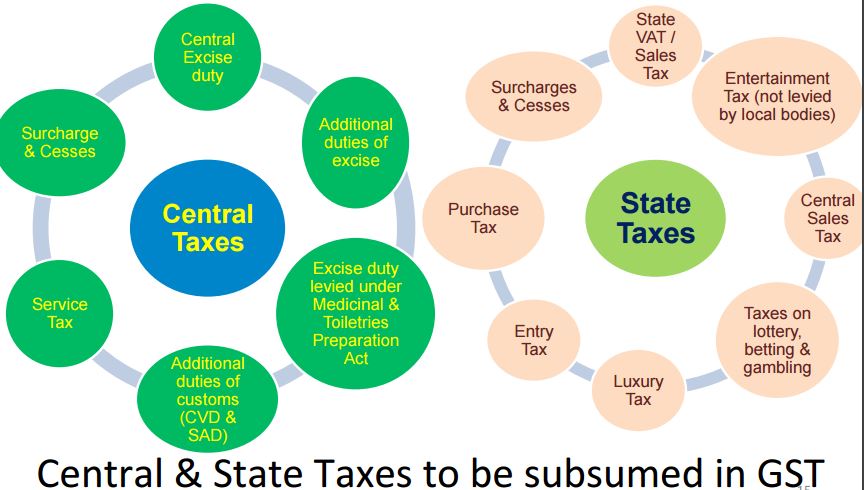

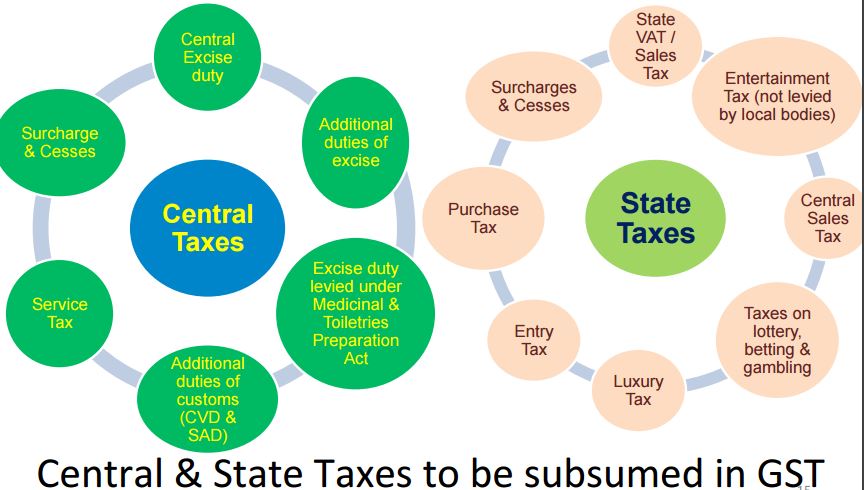

GST, which is a broad multi-stage, destination-based tax, has been adopted by various nations, each with its own unique rate and structure. It is a tax that applies to the final consumption of goods as well as services. The final buyer paying the price. Countries such as Australia, New Zealand, Canada and India have incorporated GST into their taxation systems, but with different rates and rules. For example the Australia's GST rate stands at 10%, whereas India implements a multi-tiered system that ranges from 5% to 28% depending on the type of item. This differing approach highlights the need for a flexible tool capable of traversing these different tax environments.

GSTCalculator.tax - Your Comprehensive GST Solution

GSTCalculator.tax is an indispensable solution for precise and effective GST computations. This tool online is created to be a service for individuals and businesses, enabling the calculation of GST for various transactions across many countries. It's more than simply a calculator. It's a comprehensive guide through the maze of international GST rates and rules.

The platform's user-friendly interface allows for the straightforward input of transaction values, from which it calculates the appropriate GST. This tool not just reduces time but ensures accuracy in these crucial financial calculations.

Country-Specific GST Calculations

Each country's own GST framework poses specific issues, which makes GSTCalculator.tax's ability to adapt to any situation beneficial. In Australia For instance, the tool helps businesses include or exclude the 10% GST from their prices to ensure compliance with the local laws regarding taxes. In Canada in Canada, where GST is in conjunction with Provincial Sales Tax (PST) and Harmonized Sales Tax (HST) The calculator is able to navigate these complexities.

For companies that operate in India due to its multi-tiered GST system, the tool proves invaluable in determining the correct tax rate for various items and services. In the same way, in New Zealand and Singapore, with GST rates of 15 percent and 7%, in both cases, GSTCalculator.tax makes sure that both businesses as well as individuals are able to accurately record these taxes in their financial dealings.

GST and Business Operations

In the business world, a precise GST calculation doesn't simply about compliance; it's a crucial aspect of managing finances. GST has an impact on pricing accounting, as well as the cash flow of the business. Accurate GST calculation is essential in determining the right price of services and goods as well as preparing tax invoices and making tax returns.

GSTCalculator.tax plays an essential role for businesses, helping them in effective managing their GST liabilities. It helps businesses quickly calculate the tax on their transactions, keep exact financial records, and remain in compliance with tax regulations. This precision in tax calculation and reporting is especially critical when dealing with large amounts of transactions.

The Future of GST and Digital Tools

As the global economy continues to grow, so too will the world of GST and taxation tools. Digital tools like GSTCalculator.tax are at the forefront of this evolution providing more than basic calculations. https://www.gstcalculator.tax/ signal a transition to an era of digital tax compliance in which accuracy, efficiency and accessibility are the most important factors.

The future enhancements to GST calculations tools can be expected to include more advanced features, such as Integration with accounting software and real-time notifications on tax law changes and even AI-driven tax advisory services. These advances will not just reduce tax calculation time, but also change the way companies and individuals approach taxation.

Conclusion

In an era in which taxation is as fluid as the markets that it regulates, tools like GSTCalculator.tax aren't just tools for convenience they are essential. Through reducing the complexity for GST calculation across different countries, GSTCalculator.tax stands as an invaluable ally for businesses accountants, business owners, and even individuals. Whether you're running an international corporation or need to figure out the tax implications of the recent purchase, this software makes sure that you're only one click away from precise GST calculations.

In the end, GSTCalculator.tax is more than just a calculator - it's an aid to navigate the turbulent waters of global taxation, guiding users to compliance, clarity, as well as confidence when it comes to their business decisions.