Unlocking Home Equity: The best Guide to Change Mortgage Lenders in Australia

As retirees seek to secure their particular financial future, several are embracing a great alternative solution that allows them to access the wealth tied up in their homes. Reverse mortgages have gained popularity in Australia, offering property owners a method to convert some sort of portion of their residence equity into funds without the have to have to sell their particular property. This economical product enables elderly Australians to tap into their home’s benefit while continuing to live in it, providing necessary funds for daily expenses, medical charges, or even leisure time activities.

Navigating the entire world of reverse mortgage lenders in Australia can be difficult, especially for those who may not become knowledgeable about the monetary jargon or the specific terms connected with these funding. Understanding the alternatives available, lenders them selves, and the linked costs is essential for making an knowledgeable decision. In this manual, we will explore the landscape involving reverse mortgage lenders in Quotes, highlighting what to look for and how to choose the best lender to fit your needs.

What is a Reverse Mortgage?

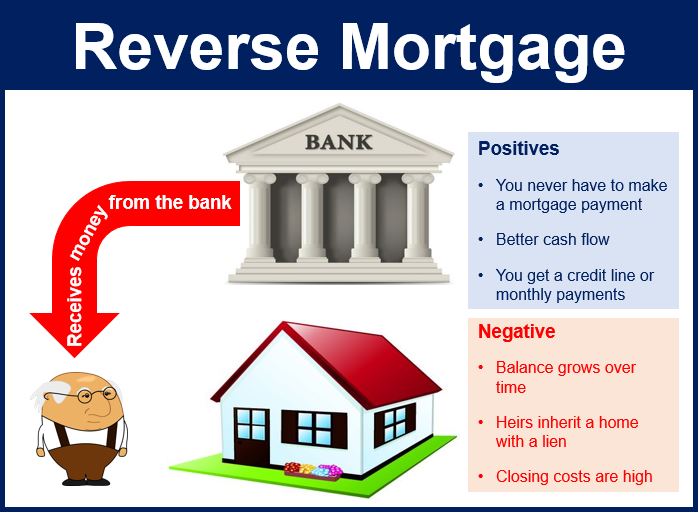

The reverse mortgage is definitely a financial item designed for more mature homeowners, typically age 60 and above, letting them access the equity in their particular homes and not having to market or relocate. This specific type of mortgage enables homeowners to borrow against the particular value of their home, receiving funds in a lump sum, regular payments, or even a line of credit. Significantly, the loan does not necessarily need to end up being repaid until the particular homeowner moves out there of the house, sells it, or perhaps passes away.

Through the reverse mortgage loan, seniors can employ the funds with regard to various purposes, these kinds of as covering bills, financing healthcare, or making home improvements. Unlike traditional loans where monthly payments are made in order to the lender, within a reverse mortgage, the eye is added to the loan balance, meaning that the total amount owed increases over time. This alternative provides a means for retirees to enjoy financial flexibility while remaining in their precious homes.

It is crucial for potential borrowers to know the implications involving a reverse mortgage loan, including how it is going to affect their real estate and any gift of money left to heirs. Consulting with monetary advisors and researching different reverse mortgage lenders in Australia will help house owners make informed selections about whether this product aligns using their financial goals and wishes.

How Reverse Mortgages Work

The reverse mortgage is actually a financial product specifically designed for older property owners, allowing them in order to convert section of their own home equity straight into cash while keeping ownership of their own property. This form of mortgage typically appeals to retirees who may always be house-rich but cash-poor, as it offers a way to gain access to funds for dwelling expenses, medical costs, or even home renovations without having to sell their particular home.

With a reverse mortgage, the lender makes payments to the homeowner instead of the other way about. The amount offered to borrow is determined by numerous factors, including the homeowner's age, the value of the property, and prevailing interest rates. As being the loan balance improves over time, thanks to rolled-up attention, the homeowner will be not required to be able to make any repayments while living inside the home. Repayment of the personal loan usually occurs when the homeowner provides the property, movements out, or moves away.

It is important for homeowners to understand that while a new reverse mortgage offers increased income, that may reduce the particular quantity of equity left in the house for heirs. Borrowers must also remain responsible for house taxes, insurance, and maintenance costs. Choosing a reputable reverse mortgage lender is crucial to ensure that all words are clearly understood and to steer clear of any potential problems associated with this specific financial product.

Benefits involving Reverse Loans

Reverse mortgages offer several positive aspects for homeowners, particularly those in their own retirement years. reverse mortgage agents of the main benefits is the particular ability to access the equity developed in the house without the necessity of selling the home. This may provide senior citizens using the financial versatility to cover living charges, healthcare costs, or even to satisfy personal desires such as travel or hobbies. By transforming home equity into cash, many get that they could maintain their desired lifestyle while perfectly residing in a common environment.

Another significant gain of reverse home loans is that these people do not require monthly repayments, which often can alleviate economical stress for a lot of older persons. Instead, the loan is paid back if the homeowner goes out of our home, sells typically the property, or passes away. This feature allows individuals in order to use their place equity minus the immediate burden of each month loan payments, making it easier to manage costs during retirement. With regard to many, this can lead to more freedom in order to choose how their cash is spent, particularly when unexpected expenses arise.

Finally, invert mortgages provides a safety net with regard to retirees. For those who may deal with rising healthcare costs or other unexpected financial challenges, possessing access to house equity can function as a crucial way to obtain funds. This flexibility ensures that seniors can reside independently longer, with no the fear involving depleting their personal savings too quickly. Overall, change mortgages can get a powerful application for managing financial situation and enhancing standard of living in later yrs.

Crucial Considerations

When exploring reverse mortgage lenders in Australia, you will need to understand the ramifications of taking out and about a reverse home loan. Borrowers should think about their long-term financial ideas, as a change mortgage can impact retirement savings in addition to inheritance for family. It is very important evaluate exactly how the loan sum will affect upcoming estate planning in addition to whether it will eventually reduce the ability to be able to access equity in the future on.

Interest rates and fees associated with change mortgages can differ significantly among loan providers. It is recommended for potential consumers to look around and compare the phrases offered by different loan providers. Learning the cost construction is vital, as substantial fees could decline the benefits associated with accessing home fairness. Reading the fine print and inquiring questions will help ensure clarity about the ongoing expenses involved.

Another key thought is the standard of customer support supplied by the lending company. Typically the reverse mortgage process can be sophisticated, and having a lender with receptive customer support can make all the distinction. Look for lenders of which offer thorough advice throughout the app process and provide support beyond the particular loan approval, making sure that borrowers experience informed and cozy with the decision.

Top Change Mortgage Lenders in Australia

Whenever considering a reverse mortgage, it will be essential to evaluate the top lenders in Australia who specialize found in this financial merchandise. One of them, the Seniors Equity Release is renowned for the customer-focused approach, providing competitive interest prices and flexible loan choices tailored for older persons. Their commitment to be able to transparency and help throughout the process makes them a well-liked option regarding many homeowners seeking to unlock their fairness.

One more notable lender will be Homestart Finance, which gives various reverse home loan solutions designed to cater to the unique needs of more mature Australians. Using a solid emphasis on individualized service, Homestart Financing helps borrowers get around the complexities involving reverse mortgages. Their very own user-friendly online program also allows prospective clients to easily accessibility information and tools to facilitate well informed decision-making.

Lastly, Australian Seniors Finance has set up a solid popularity in the markets. They offer a variety of reverse mortgage goods with features that appeal to retirees, like the ability in order to access funds when continuing to live in their very own homes. Their devoted team of professionals is available to steer clients through the entire process, through initial inquiry to be able to finalizing the home loan, ensuring an unlined experience for borrowers.

Application Process Guide

The application form process for receiving an invert mortgage nationwide typically begins with complete preparation and examination. Homeowners should very first evaluate their economical situation and determine how much equity they also have in their house. Make sure you consult with a financial expert or a reverse mortgage loan specialist to recognize the implications and even benefits of this financial product. This particular initial step ensures that applicants make educated decisions tailored to their specific requirements.

As soon as the homeowner is definitely ready to proceed, they will approach reverse mortgage lenders. The lending company will demand an application contact form along with looking after documentation, such since identification, proof of salary, and information on the particular property. Many loan providers offer online apps for convenience. Throughout this stage, it is essential to ask questions and clarify any uncertainties regarding fees, interest rates, plus repayment options, ensuring that all features of the loan are transparent.

After distributing the applying, the lender will conduct a good assessment, with a real estate valuation to ascertain the current market worth. This step is critical because it ensures the maximum loan amount available to the borrower. Right away the assessment, the particular lender will give a package detailing typically the loan terms. If the borrower accepts the offer, the final paperwork will be prepared, and the funds can be utilized, completing the applying process for an invert mortgage in Sydney.

Frequent Myths About Reverse Home loans

Lots of people believe of which reverse mortgages result in losing ownership regarding their home. This can be a common misconception which could deter potential borrowers. In reality, property owners retain ownership although receiving funds through the equity throughout their property. Provided that they meet specific obligations, such seeing that maintaining the residence and paying home taxes, they will carry on living there intended for as long as they wish.

Another fable is that opposite mortgages are a solution only regarding those in dire financial situations. When they can provide financial relief for the people struggling, reverse home loans can also benefit homeowners looking in order to enhance their old age lifestyle. Many persons use these lending options to fund travel, health care, or other personal interests, demonstrating that will they can certainly be a versatile financial application.

An extra misconception is that reverse mortgages are really too expensive in addition to laden with costs. While there happen to be costs associated using obtaining a turn back mortgage, such as upfront fees and interest rates, you have to take into account the overall financial landscape. When as opposed to other monetary options available in order to retirees, reverse home loans can often be a more advantageous choice, allowing with regard to access to substantial money without the need for instant repayment.

Conclusion and Following Steps

Navigating the world of reverse mortgage lenders in Australia may be both exciting and daunting. Understanding the particular options available, the connected costs, and the impact on economical future is essential. While you consider employing your house equity, arm yourself with expertise and resources to help in making knowledgeable decisions.

Take the time to compare various lenders and their particular offerings. Take a look at service fees, interest rates, as well as the flexibility of repayment options. It may also be advantageous to seek advice from financial pros who can offer insights tailored to your unique situation. Gathering all relevant data will empower a person to pick the best invert mortgage lender that will aligns with your needs and goals.

Finally, once a person have identified the ideal lender, initiate the applying process. Ensure of which you fully understand the terms and situations before committing. Being proactive and complete will pave the way for any smooth experience as you uncover the potential of your property equity, permitting you to take pleasure in financial peace of mind within your pension years.