Get better at Your Finances: Release the Power of a Spending budget Planner Calculator

Managing finances effectively can often feel like an overwhelming process. With assorted expenses, revenue sources, and monetary goals to facilitate, it is easy to lose monitor of where your money is going. This is how a price range planner calculator will come into play, helping as a powerful instrument to help you gain handle over economical condition. By using some sort of budget planner finance calculator, you could visualize the income and costs, set realistic objectives, create informed choices about your spending routines.

Whether or not you're aiming in order to save to get a vacation, pay off credit card debt, or simply make sure that you're dwelling within your means, a budget coordinator calculator can give clarity and structure to your economic planning. It permits you to create a tailored budget that shows your specific circumstances, aiding you track your current progress and adjust as needed. Using the right method and tools with your disposal, you may master your costs and unlock a new more secure and fulfilling financial potential future.

Knowing Budget Planners

Budget organizers are essential resources that help men and women manage their financial situation effectively. By traffic monitoring income and charges, these planners provide a clear overview of where money is being allocated in addition to identify areas where financial savings can be produced. A well-structured price range planner can function as a roadmap for achieving financial goals, whether saving for a holiday, settling debt, or even finding your way through retirement.

The primary function of a new budget planner will be to establish a new realistic spending plan based upon personal financial situations. This involves categorizing expenses into fixed and adjustable costs, which allows consumers to see their very own spending patterns create informed decisions. With the insights gained from a budget planner, individuals can prioritize their own financial needs that a sustainable technique to reach their goals.

Utilizing a budget planner finance calculator enhances the budgeting process by automating calculations and delivering instant feedback on financial choices. This technology makes it easier to see the effect of investing habits and prospective changes, leading in order to more informed decision-making. As users input their financial files, the calculator helps highlight discrepancies and encourages disciplined economic management, ultimately cultivating a healthier monetary future.

Benefits of By using a Budget Planner Online car loan calculator

A new Budget Planner calculator simplifies typically the financial planning process by providing the clear summary of your current income and expenses. This tool assists you visualize your own financial situation, allowing you to identify where your hard earned money goes each calendar month. By tracking your own spending habits, you can make educated decisions about where you can cut back plus how to designate funds more efficiently.

Another significant advantage of using a Budget Planner calculator is its capacity to set and observe financial goals. If you are saving for a vacation, paying off financial debt, or building an emergency fund, this calculator can support you create useful steps to attain those objectives. That allows you in order to set realistic focuses on and monitor your progress, that can be encouraging and supportive in achieving your financial dreams.

Moreover, a Budget Planner calculator increases financial discipline by simply encouraging regular opinions of your budget. By consistently evaluating your financial situation, you develop the deeper comprehension of your spending patterns plus can make required adjustments. This continuous engagement with your own finances fosters a new proactive approach, ultimately resulting in better economic health insurance and stability in the long work.

How to Choose the correct Budget Planner

Choosing the right budget advisor is essential regarding effective financial managing. Start by deciding your particular needs plus financial goals. Consider whether you would like a simple application for tracking everyday spending or the more comprehensive calculator that includes savings targets and investment traffic monitoring. Different planners accommodate to various economic situations, so understanding your preferences will be the first step in making a knowledgeable selection.

Up coming, evaluate the attributes offered by various budget planner calculators. Try to find functionalities enjoy customizable categories, charge tracking, and visual charts that aid you analyze your current spending habits. Lots of planners also provide features for setting monetary goals and reminders for bill repayments, which can be extremely beneficial. A new user-friendly interface is definitely also important, mainly because a straightforward style can make spending budget less daunting and even more enjoyable.

Lastly, look at whether you like some sort of digital or document format for your current budget planner. Electronic planners often arrive with mobile apps for easy access and the ability in order to update away from home. Upon the other palm, some people find that writing things down in a physical planner helps them better match their finances. Assess what works best for your way of life plus ensure that the particular planner you pick is one that you will actually use regularly.

Setting Up Your Budget

To get started the journey associated with effective budgeting, the first step will be to gather all financial information. This particular includes income resources such as wages, bonuses, and virtually any side hustles, since well as repaired expenses like lease or mortgage payments, utilities, and insurance policy. It's also important to identify shifting expenses such as groceries, entertainment, in addition to eating out. Having a new clear picture of your financial scenery will help a person make informed decisions as you set up your budget.

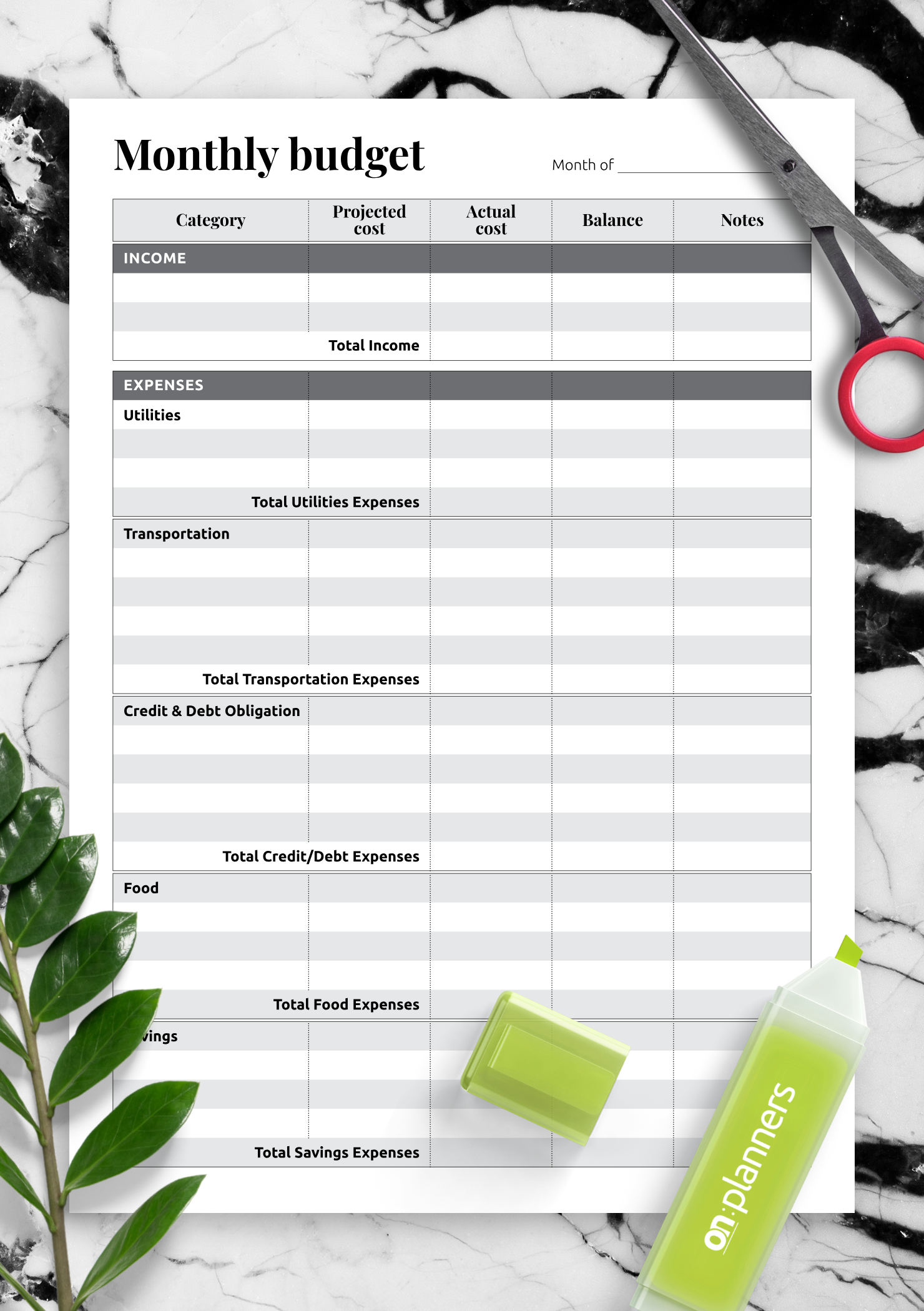

Once an individual have compiled just about all necessary financial files, it's time in order to input these numbers with your Budget Planner calculator. Start off by entering your own total income at the top involving the calculator. Then, categorize your charges by listing all of them clearly. The online car loan calculator usually enables you to allocate specific amounts with regard to each expense type, making it effortless to see where your money should go monthly. This organized approach will provide you a standard to work alongside.

After setting upwards your Budget Planner calculator, assessment the results. Examine whether your costs align with your income and economic goals. If an individual find that wasting exceeds income, changes will need in order to be made. This can involve cutting back again on non-essential items or finding ways to increase your income. With a new well-organized budget in place, you will be better prepared to take charge of your finances and work at achieving your own financial objectives.

Tracking Expenses Effectively

Keeping track involving your expenses is a vital stage in mastering finances. It allows an individual to see where your money is certainly going and identify locations where you might always be overspending. A Budget Planner calculator can simplify this specific process significantly simply by compiling all your own expenses in a single place, making it easier to analyze your investing habits. Regularly updating your expenses ensures that you have a good accurate picture associated with your financial scenario, which can be crucial regarding making informed judgements.

A single of the best ways to track your expenses efficiently is always to categorize these people. Whether you independent your expenses in to fixed costs, varying costs, and discretionary spending, categorization helps you understand which usually areas consume many of your spending budget. The Budget Planner calculator may help you picture these categories in addition to adjust your shelling out priorities accordingly. Establishing limits within every category enables a person to curb unwanted spending and fosters lager better financial discipline.

Moreover, make it some sort of habit to overview your expenses regular or monthly. This specific consistent practice not really only keeps you accountable but furthermore highlights patterns within your spending. A new Budget Planner calculator can generate reports that echo your financial habits over time, producing it easier to identify trends or continuing costs that need to have attention. By on a regular basis reviewing your expenses, you empower oneself to make proactive changes and look after control over your economical future.

Common Budgeting Faults to prevent

Probably the most common errors people make if using a budget coordinator calculator is failing to track almost all expenses accurately. Many individuals underestimate their spending habits, often omitting smaller purchases that could add up considerably as time passes. It will be essential to accounts for every dollar spent, no matter how unimportant it may seem to be. This practice not only offers a real picture of exactly where your current money goes but in addition helps in identifying areas where you may cut back.

Another regular error is establishing unrealistic financial aims. When using a new budget planner calculator, it's vital that you established achievable objectives of which align with your earnings and necessary charges. Overly ambitious cost savings targets or excessive spending cuts can lead to stress and discouragement. Reflect on your financial goals regularly to make certain they remain reasonable and attainable, which can help maintain motivation and commitment in order to your budgeting prepare.

Last but not least, neglecting to review and update your budget regularly can guide to financial stumbling blocks. Life changes like job loss, an increase, or unexpected expenses can significantly influence your financial scenario. Failing to adapt your budget advisor calculator accordingly can lead to overspending or not really saving enough for future needs. Help to make it a behavior to revisit your finances on a monthly basis, and produce adjustments as required to stay on track with your financial goals.

Adjusting Your Budget Over Time

As an individual progress through your financial journey, this is essential to be able to regularly revisit plus adjust your financial budget. Life circumstances change, no matter if due to career changes, shifts inside of living expenses, or even unexpected emergencies. By using a spending budget planner calculator, it is simple to input new earnings levels or cost categories, allowing a person to observe how these types of changes impact your own overall financial image. This ongoing assessment ensures that your current budget remains related and effective in helping you accomplish your financial objectives.

One more key aspect associated with adjusting your budget is recognizing your spending designs. Over time, you may discover that certain areas of your spending budget require basically money. For instance, if you locate that you consistently underspend in entertainment but overspend in groceries, it might be time to be able to reallocate funds. A budget planner calculator can simplify this particular process by delivering visual representations regarding your spending habits, making it less difficult to identify where changes are essential.

Finally, celebrating small victories and milestones are able to keep you motivated to stick with your budget. While you create adjustments to see advancements in your monetary health, take the time to admit these achievements. Whether or not you have effectively built an urgent fund or paid out off debt, traffic monitoring these milestones in the budget planner finance calculator can provide some sort of sense of achievement. Staying flexible plus responsive to your current financial situation will certainly empower you control of your finances in the long run.

Maximizing Savings along with a Budget

Making a budget prepare is probably the most powerful ways to improve your savings. Simply by using a budget planner calculator, it is simple to allocate your salary to various expenses, making sure that you not just meet your wants but also set cash aside for personal savings. This strategic technique permits you to track exactly where your money is going and even identify areas in which you can lessen, fostering a mentality focused on cost savings.

A great essential aspect of maximizing savings involves establishing clear financial aims. By entering these kinds of goals into your own budget planner online car loan calculator, you can visualize your progress and remain motivated. Whether it's saving for a vacation, a new car, or building an unexpected emergency fund, having particular targets makes this easier to prioritize savings over needless spending. Regularly researching and adjusting your budget helps a person stay aligned with your objectives.

Finally, consider implementing a reward program tied to your budgeting efforts. Whenever you achieve a financial savings milestone, treat on your own to a small indulgence. This not only makes typically the process enjoyable although also reinforces the particular positive behavior regarding budgeting. Using some sort of budget planner online car loan calculator permits you to create some sort of financial roadmap of which aligns with the goals, ultimately leading to improved savings and financial freedom.