A Significance of Specialized Equity Analysis in Current Financial Market

Within the current dynamic financial environment, crafting informed financial decisions is ever essential now than ever. Due to the surplus of information accessible, it can be difficult for private investors to manage the challenges of the stock markets. This is the point at which the knowledge of investment analysts is critical. These experts provide a comprehensive understanding of market trends, company performance, and valuation metrics that can help investors make educated choices.

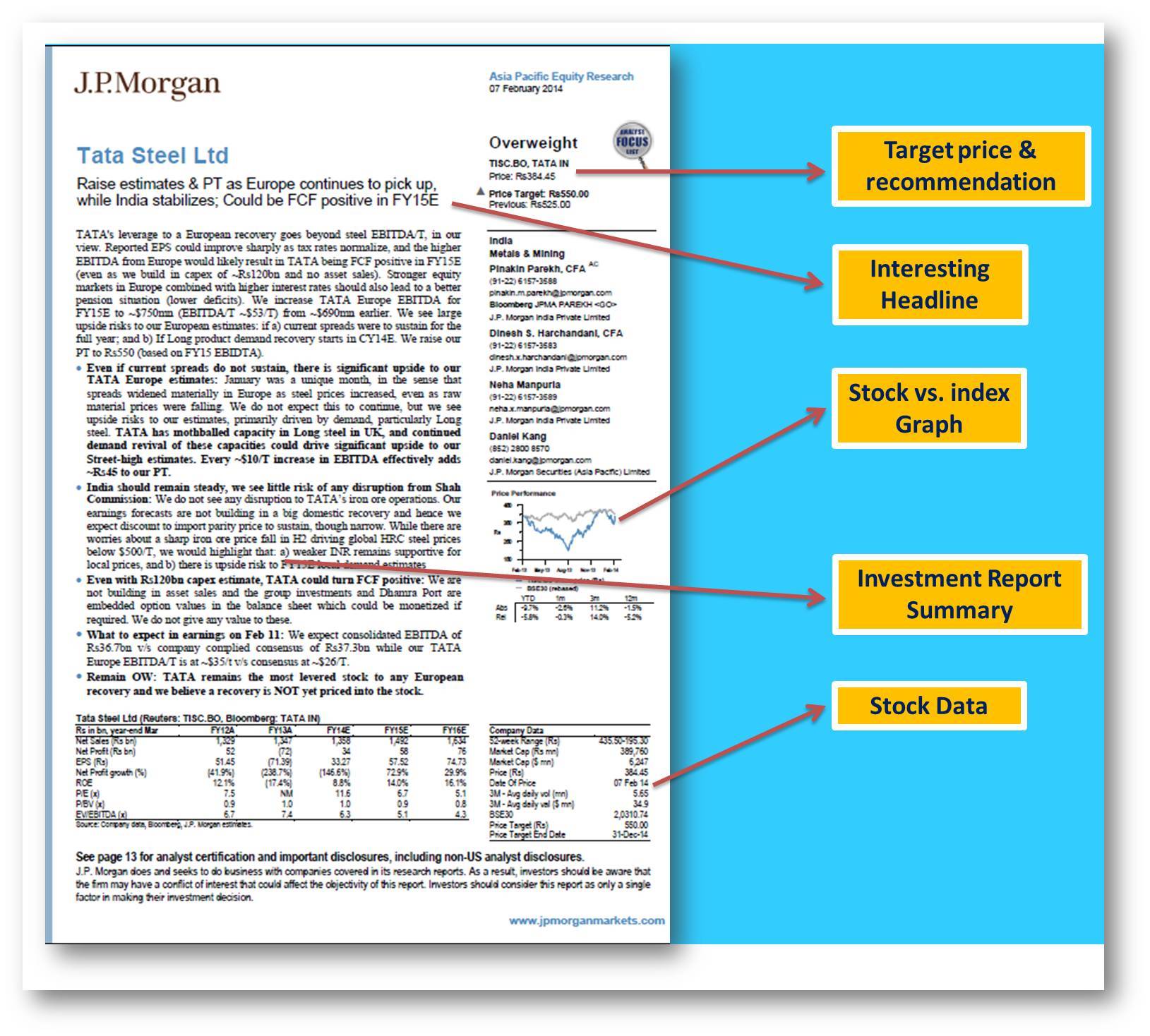

Utilizing leveraging the talents and perspectives of investment analysts, investors can unlock substantial gains. equity research report can spot possible investment prospects, lower risks, and create approaches that match with their investment objectives. In a financial environment characterized by turbulence and swift transitions, having access to expert financial analysis can be the distinction between realizing substantial returns and experiencing disappointing results. Following the guidance of these experts enables investors to manage risk with confidence.

Comprehending Stock Evaluation

Equity evaluation is a crucial process that involves analyzing a business's stock to establish its value and potential for subsequent expansion. Evaluators examine multiple aspects of a firm, such as financial statements, industry conditions, and economic indicators. This thorough assessment helps shareholders make informed decisions about purchasing, holding, or divesting stocks. Understanding the intricacies of stock evaluation allows people to navigate the equity market with increased assurance.

In today’s rapid and frequently volatile market, having a solid grasp of equity analysis is more important than ever. It can deliver important perspectives into a firm's operations and its prospects for expansion, factoring in variables such as market dynamics and competitive standing. By leveraging these insights, stockholders can place themselves strategically to take advantage of market opportunities and mitigate possible risks.

Additionally, equity evaluation is not only a single evaluation; it is an continuous process. Industry dynamics change frequently, requiring regular monitoring and reassessment of stock positions. Engaging with experts in equity evaluation helps ensure that investors stay informed on pertinent changes and maintain a well-informed portfolio. By grasping equity analysis, investors can more effectively navigate the complexities of the financial landscape and improve their investment strategies.

Key Indicators for Assessment

When evaluating equities, several essential metrics can offer significant perspectives into a firm's financial health and opportunities for growth. One of the most commonly used metrics is the earnings valuation measure. This ratio compares a business's current share price to its earnings per share, allowing investors to gauge whether a stock is overvalued, undervalued, or fairly priced in relation to its earnings. A high P/E ratio might suggest that the market has elevated expectations for upcoming growth, while a low P/E ratio may indicate that the stock is undervalued or that the firm is facing challenges.

Another important metric is the ROE. This indicator indicates how effectively a firm is using investors' equity to generate profits, calculated by dividing net income by investor equity. A high ROE signifies that the company is proficient in generating returns on investment, which is appealing to investment analysts and investors alike. Understanding ROE helps shareholders assess whether the firm is effectively deploying its resources to drive growth and profitability.

Finally, analysts frequently evaluate the debt-equity ratio to understand a business's financial leverage and risk profile. This ratio compares a firm's total liabilities to its shareholder equity, providing insight into how much debt is being used to finance the business. A decreased debt-to-equity ratio generally suggests a more financially stable firm, while a increased ratio may indicate increased risk. By assessing these essential metrics, equity analysis specialists can help investors make informed decisions based on a detailed understanding of a firm's valuation and financial health.

The Impact of Market Trends

Trends in the market play a crucial role in molding investment strategies and can substantially influence the outcomes of stock analysis. Understanding these trends allows analysts to detect opportunities and risks that might not be easily apparent. For example, a rising trend in tech adoption can lead to a increase in stock prices for companies within that sector. Equity analysis specialists can leverage this knowledge to recommend investments that fit current market dynamics, helping investors benefit from growth potential.

Moreover, the impact of economic indicators such as rates of interest, price increases, and employment rates cannot be ignored. These factors often shape the overall market sentiment and can lead to quick changes in stock performance. Professionals in equity analysis use these indicators to modify their forecasts and portfolio recommendations, guaranteeing that their clients are well-positioned to navigate fluctuations in the market. This specialized knowledge is invaluable for making informed investment decisions.

Finally, market sentiment, influenced by investor psychology and external news, also affects stock valuations. Stock market analysts are adept at evaluating these emotional responses and how they correlate with up-to-date data. By understanding how external events, such as geopolitical tensions or shifts in economic policy, can sway investor behavior, these specialists can provide insightful guidance that helps clients steer clear of bottlenecks and take timely opportunities in the equity market.