“The Future of Insuring Businesses in a Post-Pandemic World”

Introduction

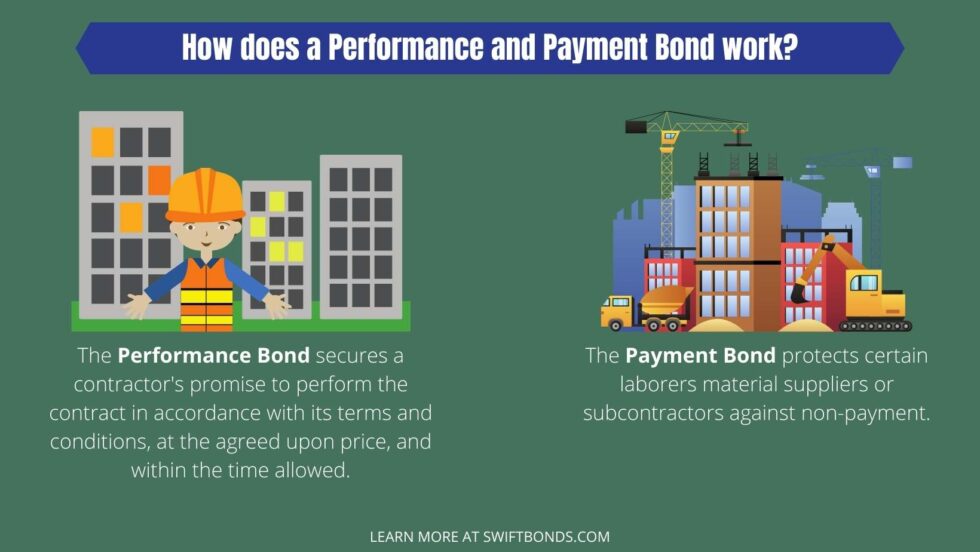

The global pandemic has reshaped numerous industries, and the insurance sector is no exception. As businesses emerge from the clutches of COVID-19, they must navigate a new landscape characterized by heightened risks and evolving consumer expectations. In this article, we will delve into “The Future of Insuring Businesses in a Post-Pandemic World,” exploring how insurers can adapt to types of surety bonds these changes while ensuring that businesses remain both insured and bonded.

The Future of Insuring Businesses in a Post-Pandemic World

As we transition into what many are calling the “new normal,” business operations have fundamentally changed. Remote work has become commonplace, digital transformation has accelerated, and consumer behavior is shifting. Insurance providers must respond to these changes by re-evaluating their products and services to meet the unique needs of today’s businesses.

Understanding the New Risk Landscape

Evolving Risks in a Post-Pandemic Economy

With the onset of the pandemic, businesses faced unprecedented challenges—some adapting swiftly while others struggled to stay afloat. The post-pandemic period presents an array of new risks, including:

Cybersecurity Threats: As organizations increasingly rely on technology for remote operations, the risk of cyberattacks has surged. Supply Chain Disruptions: The pandemic exposed vulnerabilities within supply chains, leading to increased uncertainty. Health and Safety Compliance: Businesses are now tasked with adhering to stricter health regulations to ensure employee safety.

Rethinking Insurance Coverage Models

Tailoring Policies for Modern Needs

One size no longer fits all when it comes to insurance policies. Insurers must offer customized solutions that reflect today’s dynamic business environment:

Flexible Policies: Include options for short-term coverage or pay-as-you-go plans that can scale with business needs. Comprehensive Cyber Liability Insurance: Protect against data breaches and other online threats. Business Interruption Insurance: Cover potential losses due to unforeseen disruptions. surety bonds

Digital Transformation in Insurance

Leveraging Technology for Better Services

The insurance industry is becoming increasingly tech-savvy. Digital tools facilitate streamlined processes and improve customer experiences:

Online Portals allow clients to manage their policies conveniently. AI-Powered Claims Processing speeds up adjudication times and reduces human error. Data Analytics help insurers assess risks more accurately and tailor products accordingly.

Customer-Centric Approaches in Insurance

Understanding Customer Needs Post-COVID

In this post-pandemic world, understanding customer needs is paramount:

Conduct surveys or focus groups to grasp changing expectations. Use CRM systems for personalized communication based on customer behavior.

Insuring Against Unforeseen Events

The Importance of Business Interruption Insurance

Why Every Business Needs It

Business interruption insurance provides essential coverage during unexpected events that disrupt operations. This insurance covers lost income during downtime due to disasters or emergencies. For any business aiming for sustainability, having such coverage is indispensable.

Risk Management Strategies for Small Enterprises

How Small Businesses Can Protect Themselves

Small businesses often lack resources but can still implement effective risk management strategies:

Regularly review insurance needs based on evolving business models. Invest in staff training on health protocols. Develop contingency plans for crisis management.

Navigating Legal Regulations in Insurance

Understanding Regulatory Changes Post-Pandemic

Keeping Up with Compliance Requirements

Regulatory frameworks are continuously evolving as authorities adapt to new challenges posed by the pandemic:

Stay informed about changes in labor laws regarding employee safety. Ensure compliance with updated health regulations affecting business operations.

The Role of Brokers in a Changing Marketplace

How Brokers Are Adapting Their Roles

Insurance brokers serve as intermediaries between clients and insurers, providing valuable guidance:

They can help businesses identify appropriate coverage options tailored to their unique risks. Brokers play a crucial role in educating clients about new products reflecting current market realities.

Innovative Products Shaping the Future of Business Insurance

Introducing Parametric Insurance

Parametric insurance offers payouts based on specific triggers rather than traditional loss assessments:

Provides quicker settlements during catastrophes like natural disasters. Simplifies claims processes by eliminating lengthy investigations.

Microinsurance: A Game-Changer for Startups

Microinsurance products cater specifically to startups needing affordable coverage options without excessive premiums:

Tailored plans ensure startups are adequately protected against common risks. Encourages innovation by reducing financial barriers associated with traditional insurance models.

FAQs About Insuring Businesses Post-Pandemic

What types of coverage should businesses prioritize?

Businesses should consider comprehensive general liability insurance, property insurance, cyber liability insurance, and business interruption coverage as essential components of their risk management strategy.

How has COVID-19 affected insurance premiums?

While some businesses see increased premiums due to heightened risks related to COVID-19 (like health liabilities), others may benefit from lower rates if they have adopted robust risk mitigation measures.

Are there specific policies designed for remote work?

Yes! Many insurers now offer customized policies that address risks associated with remote work environments, including cybersecurity threats and equipment protection.

How can small businesses afford adequate insurance coverage?

Small businesses can explore group purchasing options through industry associations or seek out microinsurance products tailored specifically for startups which provide necessary protection at lower costs.

What measures should companies take before filing an insurance claim?

Before filing a claim, companies should document all relevant information regarding the incident causing loss or damage comprehensively while reviewing their policy terms carefully.

Is it possible to get flexible payment terms from insurers?

Yes! Many insurers now offer flexible payment plans catering specifically to varying cash flow situations faced by businesses post-pandemic.

Conclusion

As we venture further into the post-pandemic era, understanding "The Future of Insuring Businesses in a Post-Pandemic World" remains crucial for both insurers and organizations alike. The landscape demands adaptability; thus adopting innovative approaches will be pivotal for success moving forward. Moreover, ensuring that companies remain both insured and bonded will not only safeguard them against unforeseen challenges but also foster resilience within our economy as we collectively recover from this global crisis.

By embracing change and remaining proactive about emerging risks—whether through technology advancements or tailored policies—businesses can not only survive but thrive amidst uncertainty ahead!