How Much Does Commercial Car Insurance Expense? 2023 Prices

What Does Business Automobile Insurance Price? While DoorDash gives excess vehicle liability protection throughout the energetic delivery stage, you might want to get rideshare insurance policy to load the spaces. A lot of the biggest insurance provider sell industrial automobile policies. However, it's a good idea to contrast numerous companies prior to acquiring organization auto coverage. When you look for commercial car insurance policy, the insurance company will certainly assess the driving records of every individual you provide as a vehicle driver. If your staff members have a history of mishaps, speeding up tickets, or other offenses, your premium may raise. On the other hand, if all your employees have clean driving documents, it can lower your price.

Geico DriveEasy Review 2023 - MarketWatch

Geico DriveEasy Review 2023.

Posted: Thu, 28 Dec 2023 08:00:00 GMT [source]

Selecting higher deductibles will result in a reduced costs, whereas picking reduced deductibles will certainly Auto insurance & notary public near me raise your premium. Your price depends on details attributes of your company, including coverage demands and driving history. Discover the elements that affect your premium and just how to get budget-friendly commercial vehicle insurance coverage. Your location, driving document and credit score can affect the expense of your service vehicle insurance.

How Much Is The Average Industrial Car Insurance Coverage Price? (2023 Prices)

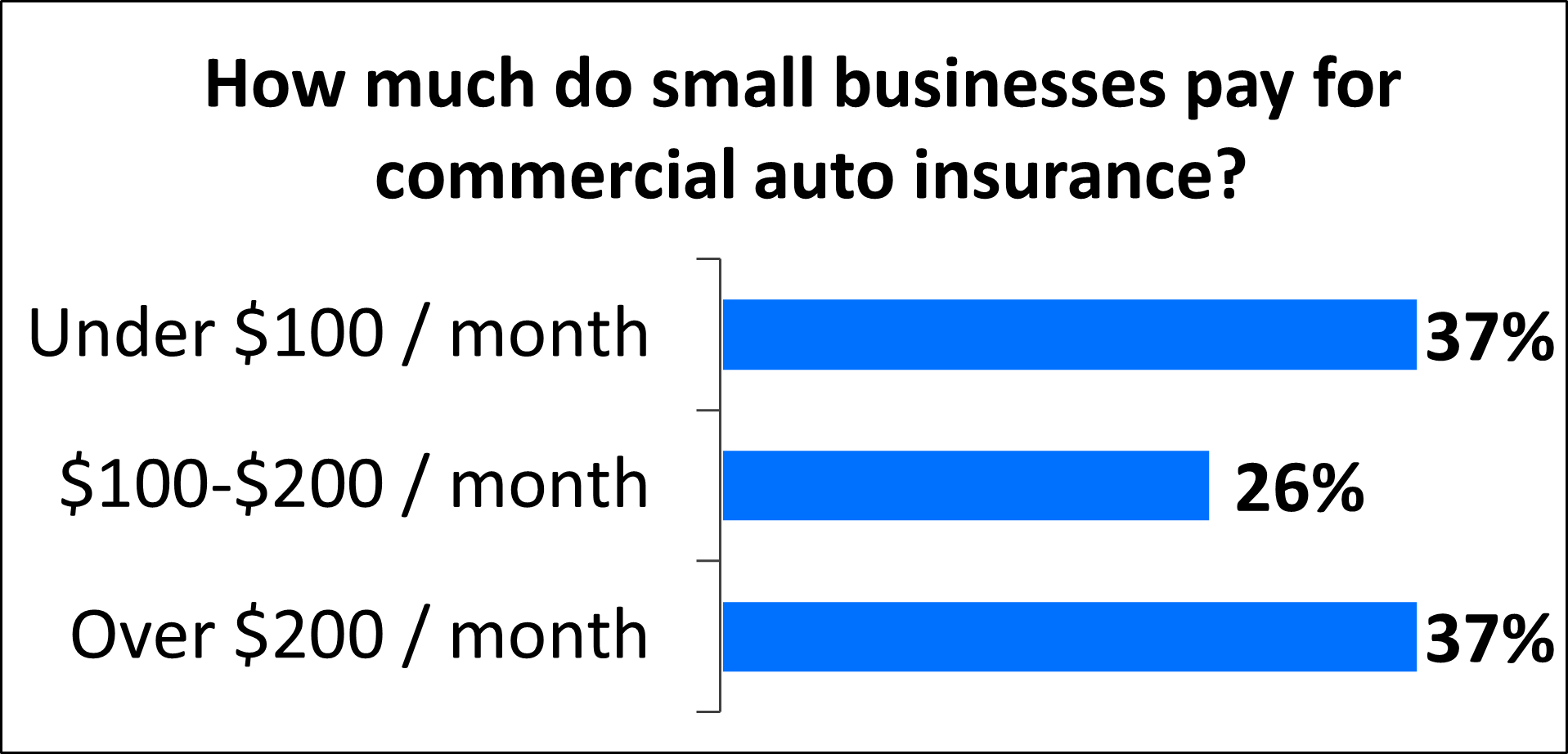

Normally, industrial vehicle insurance coverage will cost more than personal auto insurance policy because it secures you against extra pricey threats and supplies a greater level of protection. A personal vehicle plan typically just covers you and your immediate relative utilizing your car for non-business driving, like errands and travelling to and from job. If you choose comprehensive and collision coverage, for an extra costs, you obtain insurance coverage for damage to the business-owned cars, based on the deductible alternative bought. Comprehensive industrial car insurance coverage covers theft and damages caused by weather condition, criminal damage, or fire. Crash insurance coverage pays for the repair work or replacement of had cars resulting from a collision with another automobile or things. The threats facing your market can likewise influence how much you need to spend for commercial auto. To satisfy your state's insurance coverage needs, you need to bring a minimum quantity of insurance coverage.For instance, a food truck full of important equipment or a tow vehicle that's always on the road will likely have greater rates.If you utilize a leased, rented, or personal car for service functions, worked with and non-owned auto insurance coverage would certainly be the proper sort of insurance coverage for your small business. Policy terms are usually six- or 12-month durations and are eco-friendly. An insurance company will notify a consumer when it's time to renew the plan and pay an additional premium. Costs are what you pay monthly, biannually or yearly to maintain an automobile insurance plan while deductibles are quantities you pay when you sue. Freelancers can benefit from company insurance coverage, even if they don't work in-person with customers. Basic protection, including expert obligation coverage, can shield against issues like legal actions over errors or errors. Call at least 3 to five automobile insurance provider for quotes and supply them with present driver/vehicle details and coverage needs. Maine is the cheapest state in the country for auto insurance policy premiums-- the typical annual costs is $1,175 each year or simply under $100 monthly. New Hampshire is second-most pricey at $1,265 and Vermont auto insurance costs $1,319 yearly. Your staff members' driving records will certainly affect your expense of commercial auto insurance policy. An employee with a history of collisions and speeding tickets can indicate greater costs.

Best Retail Insurer & Prices For 2023

These trucks are generally heavy products trucks, like semis, that haul miscellaneous products for others. Some instances of for-hire transport consumers consist of general haulers, expeditors and owner-operators. Professionals, sub-contractors and independent tradespeople usage business vehicles like pickup, freight vans, SUVs and trailers to deliver tools and equipment on the job. Total Insureon's on the internet application and contact one of our certified insurance professionals to acquire recommendations for your specific organization insurance policy requires. As you may have presumed, transporting unsafe products positions more liability threats and conformity problems, which can drive up the cost of your costs. Guaranteeing additional lorries or using your vehicles more often also raises the rate of your policy. This can be bought as a standalone policy or is normally offered as a recommendation for basic liability insurance coverage. When it concerns finding an economical premium, shopping around is key. When you begin getting in touch with car insurance companies, it is necessary to offer all your details and needs throughout your quote consultation. The ordinary price for business car insurance policy for professionals is $215 per month. For example, a pickup truck with a ladder shelf and completely affixed tool kit could cost more to insure than a common vehicle without added attributes. Expenses for business vehicle insurance policy differ depending upon several factors. Policies for one car, which is what the complying with quotes are for, prices less than plans for multiple lorries or a fleet.