Comprehending Bookkeeping: The Foundation of Financial Management

Introduction

In the elaborate world of finance, accounting stands as a pillar that sustains not just organizations, however likewise individual monetary administration. Whether you're running a tiny café or taking care of a multinational corporation, comprehending bookkeeping is critical. It's more than just grinding numbers; it has to do with making educated choices based upon exact financial information. In this post, we'll discover numerous facets of bookkeeping, its relevance in monetary administration, and exactly how it can empower you to take control of your finances.

Understanding Bookkeeping: The Backbone of Financial Management

Bookkeeping is usually regarded as a mundane job-- a commitment as opposed to an opportunity. However in reality, it's the primary step toward efficient economic monitoring. By maintaining exact documents of income bookkeeping services near me and expenditures, companies can check their cash flow and make critical choices. Comprehending bookkeeping suggests acknowledging its duty not only as a record-keeping device yet likewise as a vital component in the broader world of financial strategy.

The Value of Bookkeeping in Business

Why Every Service Needs Bookkeeping

Every business, no matter dimension or sector, needs trustworthy bookkeeping techniques. Accurate documents assist in timely tax obligation filings, aid track expenditures, and provide insights into productivity. Without these records, businesses may encounter legal consequences or lose out on possibilities for growth.

Key Benefits of Efficient Bookkeeping

Financial Analysis: Exact information enables better analysis of economic health. Tax Compliance: Organized documents simplify tax obligation preparation and make sure compliance with regulations. Cash Circulation Management: Recognizing where money comes from and goes assists keep liquidity. Budgeting: Historical information aids in producing reasonable budgets for future planning.

Basic Concepts of Bookkeeping

Double-Entry System Explained

At the core of efficient bookkeeping lies the double-entry system-- a method that guarantees every deal affects at least 2 accounts. As an example, when you offer a product, you boost your income account while concurrently increasing your cash money or balance dues account.

Debits and Credit reports: A Basic Concept

In accounting lingo, debits and credit reports are basic ideas:

Debits rise property or expenditure accounts. Credits boost liability or earnings accounts.

This duality keeps balance within the accounting formula: Properties = Responsibilities + Equity.

The Function of Modern technology in Modern Bookkeeping

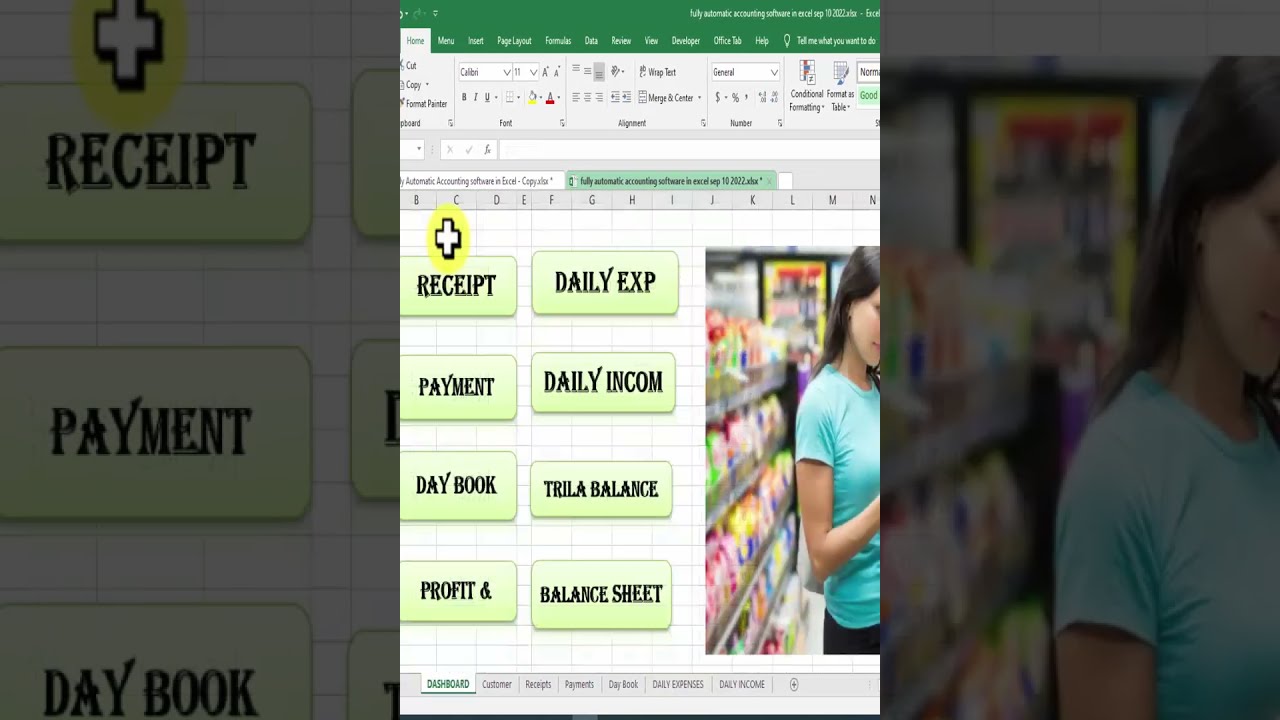

Software Solutions Transforming Bookkeeping

Gone are the days when accounting entailed endless spread sheets and manual estimations. Today's modern technology offers innovative accounting software program like QuickBooks and Xero that automate lots of facets of the process.

Benefits of Cloud-Based Bookkeeping Solutions

Cloud-based systems permit real-time monitoring and accessibility from anywhere:

Collaboration becomes seamless. Automatic updates reduce the threat of errors. Enhanced safety attributes protect delicate data.

Types of Bookkeeping Methods

Single vs Double Access Accounting: What's the Difference?

While single-entry bookkeeping tracks just cash money inflow and outflow, double-entry gives a detailed sight by taping all deals in numerous accounts. This differentiation is crucial for comprehending total monetary health.

Accrual vs Cash money Basis Accounting

Accrual accounting acknowledges earnings and costs when they happen while cash money basis accountancy identifies them just when money modifications hands. Each method has its benefits relying on business needs.

Bookkeeping Basics: Key Terms to Know

Essential Terminology Every Accountant Must Master

To browse the globe of accounting successfully, familiarize yourself with vital terms:

Ledger: A book including all accounts. Trial Equilibrium: A declaration that checks if overall debits equivalent total credits. Chart of Accounts: A listing of all account names used by an organization.

The Process of Bookkeeping: A Step-by-Step Guide

Step 1: Event Financial Documents

Start by gathering all necessary papers such as receipts, billings, bank statements, and payroll documents to guarantee you have total details for precise reporting.

Step 2: Recording Purchases Regularly

Consistency is vital! Tape daily deals to stay clear of stockpile and preserve precision in your economic records.

Step 3: Fixing up Accounts Monthly

Monthly reconciliation makes sure that your recorded deals align with financial institution statements-- an important step to determine disparities very early on.

Common Errors in Bookkeeping to Avoid

Neglecting to Maintain Receipts

Failing to maintain invoices can lead to challenges throughout audits or tax obligation period. Always document every purchase meticulously!

Mixing Individual and Company Finances

Separating personal financial resources from organization finances is crucial for clear exposure right into each entity's performance.

How to Pick an Expert Bookkeeper?

Factors to Think about When Employing a Professional

When seeking expert aid, take into consideration:

Experience level Industry knowledge Technology proficiency Communication skills

Choosing the right accountant can save time and avoid costly errors down the line!

DIY vs Professional Accounting Solutions: Pros & Cons

|Facet|DIY Accounting|Expert Solutions|| -----------------------|-------------------------------------|-----------------------------------|| Cost|Generally reduced|Greater costs|| Control|Full control over financial resources|Limited control|| Know-how|Differs relying on individual skill|Accessibility to specialized knowledge|| Time Financial investment|Needs significant individual time|Maximizes time for other tasks|

Understanding these benefits and drawbacks aids establish what choice fits your needs best!

The Future of Bookkeeping: Trends to Enjoy For

Automation's Growing Impact

With AI-powered tools emerging daily, automation will likely become essential in lowering human error-- making bookkeeping much more efficient than ever before before!

Integration with Various other Financial Systems

Expect enhanced assimilation in between bookkeeping software program and other systems like CRM systems which streamline procedures additionally by giving holistic views into business performance.

FAQs

Q1: What does a bookkeeper do?

An accountant tracks everyday economic transactions such as sales revenue and purchases while ensuring all documents are accurate and up-to-date.

Q2: How usually should I upgrade my books?

It's perfect to upgrade your books everyday or once a week to keep precision; nonetheless monthly reviews are recommended at minimum.

Q3: Can I do my own bookkeeping?

Yes! With fundamental knowledge & & tools offered today anyone can manage their very own publications-- though specialist assistance may be valuable for intricate situations.

Q4: Do I require official training to be a bookkeeper?

While official training can be beneficial & & lots of select certification programs-- it isn't strictly essential if one possesses solid organizational abilities & & attention-to-detail!

Q5: What software program is best for local business bookkeeping?

Popular options consist of QuickBooks Online & FreshBooks-- both offering user-friendly interfaces fit particularly for tiny businesses!

Q6: How do I get ready for tax obligation period with my books?

Ensure all purchases are tape-recorded properly & categorize expenditures properly-- this will certainly relieve anxiety considerably & when tax season arrives!

Conclusion

In verdict, understanding bookkeeping is critical for anyone wanting to get proficiency over their funds-- whether it be personal budgeting or managing vast corporate resources. As we have actually checked out throughout this short article labelled" Comprehending Accounting: The Foundation of Financial Administration,"reliable accounting not only promotes compliance yet also functions as a logical tool encouraging smarter decision-making processes across numerous domains within finance management frameworks! So why wait? Begin understanding your books today!