Unlocking Success: Your Ultimate Guide to Financial Model Templates

In today's fast-paced business environment, mastering the art of financial modeling is more critical than ever. As companies strive for growth and sustainability, the ability to create accurate and insightful financial forecasts can be the difference between success and failure. Financial model templates serve as essential tools for entrepreneurs, analysts, and financial professionals, providing a structured foundation to build upon and allowing for a clear visualization of complex data.

These templates simplify the often daunting task of financial planning by offering ready-made formats that can be tailored to specific needs. Whether you are budgeting for a startup, evaluating an investment opportunity, or conducting a detailed analysis of existing operations, financial model templates streamline the process. By leveraging these resources, you can focus more on strategy and less on spreadsheet mechanics, ultimately unlocking new levels of financial insight and decision-making agility.

Understanding Financial Model Templates

Financial model templates are essential tools for businesses and individuals seeking to forecast financial performance, evaluate investments, or assess potential projects. These templates provide a structured framework that helps users input their data, assumptions, and variables easily. By utilizing a financial model template, one can save time and effort in creating complex calculations from scratch, while also ensuring accuracy and consistency in their financial analyses.

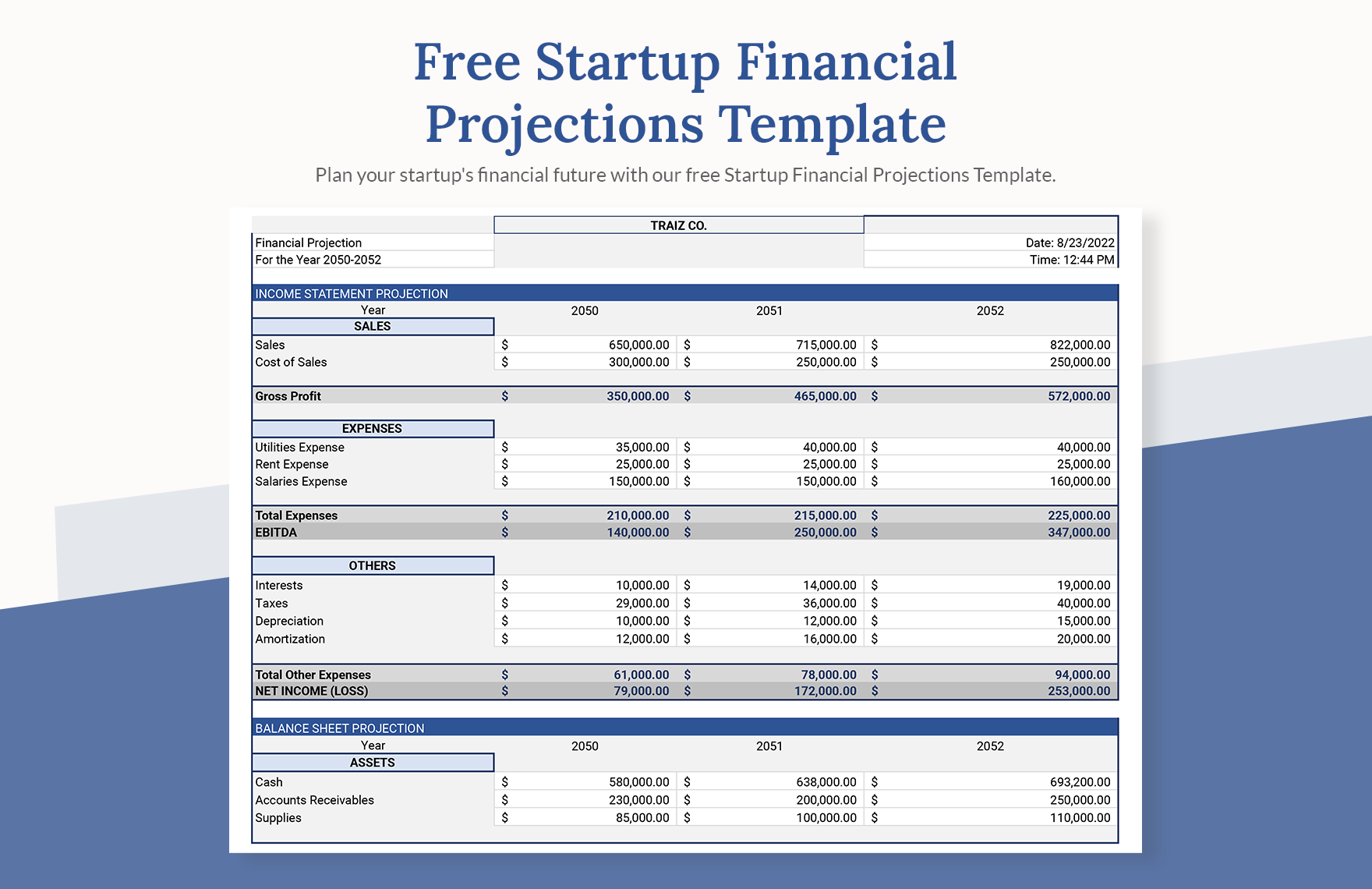

There are various types of financial model templates available, each designed to meet specific needs. For example, templates can cater to startup financial projections, valuations, budgeting, or even scenario analysis. By selecting a template that aligns with the user's particular objectives, the model can facilitate better decision-making and strategic planning. This adaptability is one of the key features that make financial model templates indispensable for professionals across different industries.

Moreover, financial models often incorporate built-in features such as charts and graphs, which can help visualize data in a more digestible format. This visualization enables stakeholders to grasp complex financial information quickly and enhances communication during presentations or discussions. As a result, using a financial model template not only streamlines the modeling process but also empowers users to convey their insights effectively, paving the way for informed decisions and successful financial outcomes.

Key Components of Effective Models

An effective financial model incorporates several crucial components that contribute to its overall functionality and usability. First and foremost, a clear and organized structure is essential. This includes having designated sections for inputs, calculations, and outputs, as well as a logical flow that guides users through the model. A well-structured model allows users to easily navigate and understand the financial data, reducing the likelihood of errors and increasing the model's reliability.

Another vital aspect is the inclusion of assumptions and drivers. Financial models rely heavily on key assumptions such as growth rates, cost structures, and market conditions. Documenting these assumptions clearly within the model not only provides transparency but also enables users to adjust inputs and see how changes affect overall results. This flexibility is paramount for decision-making and scenario analysis, allowing stakeholders to evaluate various business strategies and outcomes.

Finally, the incorporation of visual elements enhances the effectiveness of a financial model. Utilizing charts, graphs, and summary tables can help to highlight critical insights and trends in the data. Visual aids make it easier for users to grasp complex information at a glance, facilitating better communication of financial analysis. By combining structured organization, clear assumptions, and visual representation, a financial model becomes a powerful tool for driving business success.

Choosing the Right Template for Your Needs

When selecting a financial model template, it is crucial to consider the specific requirements of your business or project. Different templates serve various purposes, such as projections for startups, budgeting for established companies, or investment evaluations. Assess your goals carefully to ensure that the template aligns with your objectives. A well-suited template can streamline your financial analysis and enhance the accuracy of your forecasts.

Another important factor to consider is the complexity of the financial model. Some templates may be straightforward, offering basic financial statements such as income statements and balance sheets. Others might be more intricate, incorporating advanced calculations and sensitivity analysis. If you are new to financial modeling, starting with a simpler template may be advisable. As you become more familiar with the components, you can progress to more sophisticated models that cater to your growing expertise.

Lastly, pay attention to the design and usability of the template. A user-friendly template can save you valuable time and reduce the risk of errors. Look for templates that are well-organized, clearly labeled, and come with instructional guidelines. Also, consider the compatibility of the template with the software you plan to use. A compatible and intuitive template can greatly enhance your productivity and enable you to unlock success in your financial planning endeavors.